How to Launch Your Own Stablecoin: A Beginner-Friendly Guide

May 16,2025

How to Launch Your Own Stablecoin: A Beginner-Friendly Guide

Have you ever thought about developing your own cryptocurrency? You likely heard of Bitcoin and Ethereum, but how about stablecoins? Stablecoins are powerful crypto-assets that connect the real economy to the digital economy. The total market cap for the stablecoin market exceeded $224 billion USD in 2024— and climbing. Whether you are an entrepreneur, a fintech startup, or an enterprise looking to launch your own stablecoin/crypto-backed product in Australia or the United States, this guide will show you how to go from concept to stablecoin creation. Let’s get into the fun stuff!

What is a Stablecoin?

A stablecoin is a cryptocurrency, but the price does not vary widely as and instead is pegged to a real-world asset – an USD, an Euro, gold – economic or physical goods. . Stablecoins are years ahead of these unpredictable cryptocurrencies; they also avoid the dramatic price drops that make them not useful for transactions for everyday purchases, or for saving for purchases or payments for wages.

Stablecoin vs Bitcoin vs Fiat Currency

| Feature | Stablecoin | Bitcoin | Fiat Currency |

|---|---|---|---|

| Volatility | Low – Pegged to fiat/asset | High – Prone to market swings | Low – Controlled by central banks |

| Usability | High – Great for daily transactions & DeFi | Moderate – Mainly investment/trading use | High – Accepted for all legal payments |

| Trust | Medium to High – Depends on reserves & audits | High – Backed by blockchain transparency | High – Backed by governments |

| Decentralization | Varies – Algorithmic types are decentralized | Fully decentralized | Not decentralized – Controlled by banks |

| Transaction Speed | Fast – Depends on blockchain used | Moderate – Can be slower due to congestion | Moderate – Bank-dependent |

| Cross-Border Use | Excellent – Low fees, fast settlements | Possible – But volatile for remittance use | Limited – Expensive & slow transfers |

Types of Stablecoins Explained for Stablecoin Development

1. Fiat-Collateralized Stablecoins

Backing: Traditional fiat currencies (e.g. US Dollars, euros) stored in reserves back the stablecoins.

Examples: Tether (USDT), USD Coin (USDC), Binance USD (BUSD).

Pros: Highly liquid option, accepted widely, relatively stable.

Cons: Centralized control, transparency on reserve audits is limited.

2. Commodity-Collateralized Stablecoins

Backing: Backed by physical commodities like gold, silver or oil.

Examples: Tether Gold (XAUT) and KitCoin (which represents barrels of oil).

Pros: Hedge against inflation, tangible asset backing.

Cons: Include less liquidity, more complex trading process than fiat-backed.

3. Crypto-Collateralized Stablecoins

Backing (for these stablecoins): Backed by other cryptocurrencies (e.g., DAI is backed by Ethereum), usually needing over-collateralization due to the volatility of the backing collateral.

Examples: DAI (backed by Ethereum).

Pros: Decentralized, trustless systems.

Cons: High collateralization requirements, susceptible to backing asset volatility.

4. Algorithmic Stablecoins development

Backing: These are not collateralized and algorithmically control supply, relying on supply and demand to keep stable.

Examples: TerraUSD (UST) [now defunct], FRAX.

Pros: Not requiring reserves means these are scalable and decentralized, meaning they can offer high yield to users staking.

Cons: High risk of losing peg (value) as worth is only dependent on demand and USD relative value (worth unstable unless back by reserve or economic incentives).

5. Hybrid Stablecoins

Backing: The asset backing is a basket of different types of assets (fiat, commodities, etc).

Example: A stablecoin may be backed 50% by USD reserves and 50% by gold.

Pros: A hybrid stablecoin balances stability and diversification.

Cons: More complex management and ongoing maintenance.

6. Synthetic Stablecoins

Backing: Synthetic stablecoins are not back by physical assets, but represent “synthetic” versions of some asset — synthetic stablecoins usually use derivatives or smart contracts to establish price stability.

Example: sEUR (synthetic euro).

Pros: Utility in decentralized finance (DeFi) and easy to transfer to/from.

Cons: Credibility and solvency of the issuer of synthetic stablecoins.

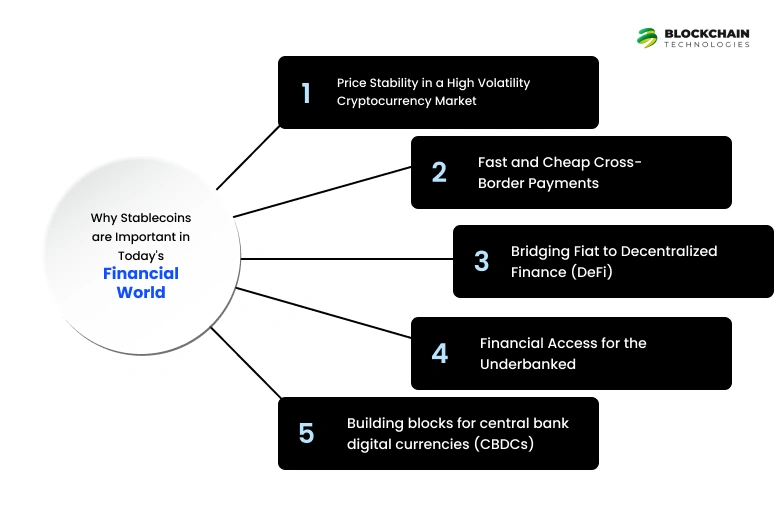

Why Stablecoins are Important in Today's Financial World

Stablecoins are more than just digital dollars — they are addressing real-world issues:

1. Price Stability in a High Volatility Cryptocurrency Market

Why it matters:

Cryptocurrencies such as Bitcoin and Ethereum are notorious for price volatility, which make impossible for the average person to use them to pay for everyday purchases or store their wealth. Stablecoins, which are pegged to stable assets (such as USD or Gold), help to mitigate the volatility of cryptocurrencies while still offering the benefits of the blockchain technology (speed, transparency, programmability).

Real-world impact:

- Exiting Safe Haven: As cryptocurrencies are extremely volatile, traders can use the stablecoins (for example USDT or USDC) to enter and exit the markets, while also being able to hold it as a non-volatile position. Meaning traders don't have to return to fiat, which could require bank transfers and fees.

- Store of value: In hyperinflation nations (e.g., Argentina, Turkey), citizens can take their savings (usually from a monthly salary) and convert it to stablecoin, like USDC, which allows them to store value and purchasing power.

- Stable base: Stablecoins provide a "neutral base" from which to price cryptocurrency assets (e.g. BTC/USDT), which removes the need for reliance on the banks during settlement.

2. Fast and Cheap Cross-Border Payments

Why it matters:

Traditional cross-border payments with SWIFT (or banks) can be painfully slow (3-5 days) and expensive (5-10%), and stablecoins provide a nearly instantaneous, low-cost process (typically under $0.01), on a blockchain network such as Ethereum, Solana or Stellar.

Real-world impact:

- Remittances: Migrant workers can use services like Bitso (Mexico) or Stellar-based wallets instead of a service like Western Union, which has very high costs.

- Business Payments: Exporters can settle invoices instantly using USDC, meaning they avoid delays in the foreign exchange market.

- Humanitarian Aid: NGOs can send stablecoins to refugees (e.g., people fleeing the Ukraine) allowing immediate access to funds.

3. Bridging Fiat to Decentralized Finance (DeFi)

Why it matters:

Most DeFi platforms (i.e., Aave, Uniswap) require crypto-native assets, but most users hold fiat. Stablecoins can bridge this gap, as stablecoins (for instance, USDC) provide users an “on-ramp,” allowing users to turn their dollars into blockchain-compatible tokens.

Real-world impact:

- Yield generation: Users can deposit stablecoins into DeFi protocols to generate interest (3-8% APY on USDC) - far higher than in a traditional savings account!

- Collateral: Borrowers can lock-up stablecoins to obtain loans in crypto without a credit check.

- Liquidity: Stablecoins represent the majority of the liquidity provided to DeFi platforms (i.e., DAI provides liquidity to Curve Finance), meaning that liquidity is available to facilitate trading, willing, and other functions. Read more about DeFi development services.

4. Financial Access for the Underbanked

Why it matters:

Over 1.4 billion people lack access to banking but have smartphones. Stablecoins offer a solution that essentially offers a digital wallet alternative in their smartphone ecosystem, and you only need an internet connection.

Real-world impact:

- Unbanked Populations: In Sub-Saharan Africa, a blockchain-based platform called Celo offers a USD-pegged stablecoin (cUSD) for savings and payment use cases.

- Microtransactions: Venezuelans are using USDT to do things like buy groceries on apps like Reserve.

- Censorship Resistance: Activists living under authoritarian regimes are buying stablecoins to sidestep frozen bank accounts.

5. Building blocks for central bank digital currencies (CBDCs)

Why it matters:

Governments are testing the waters of CBDCs – a digital version of fiat currency. Stablecoins have offered them a potential test bed for a blockchain-based monetary ecosystem.

Real-world impact:

- Technical Blueprints: Projects that utilize stablecoins (like JPMorgan's JPM Coin or Circle's USDC) provide a blueprint on how programmable and instant settlement and payments can work for [CBDCs and] governments.

- Public-Private Partnerships: Central banks (such as the ECB and the Federal Reserve) are also studying stablecoin projects globally to find a way to regulate innovation.

- Interoperability: CBDCs may offer interoperability with stablecoin ecosystems to create efficient cross-border transactions (including the Bank of International Settlements' project mBridge).

Want to launch your own stablecoin?

We can help you launch your stablecoin with compliance and confidence.

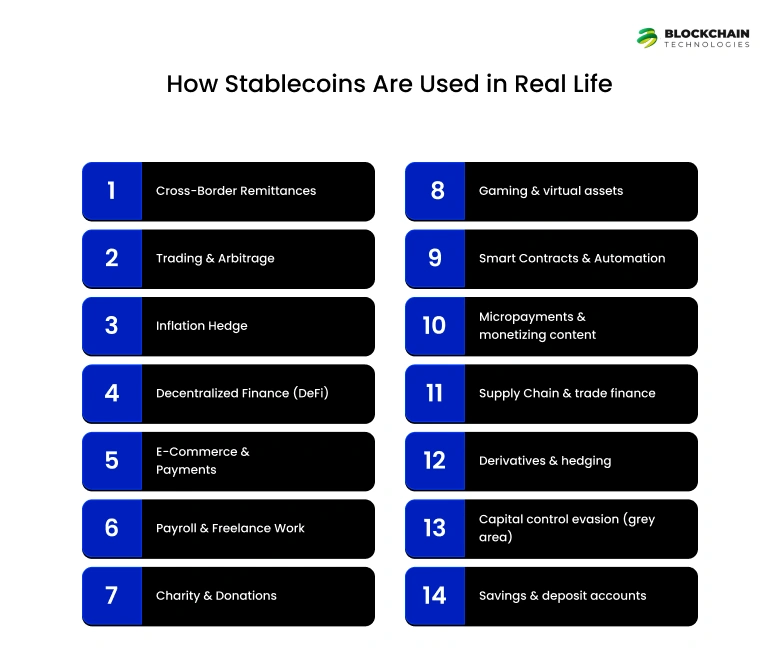

How Stablecoins Are Used in Real Life

Stablecoins, which are pegged to stable assets like the US dollar, are an increasingly flexible way to address a range of use cases in numerous sectors thanks to their price stability, regulatory frameworks, and usability on a blockchain. Here is a tabulated way of representing the real life applications of stablecoins:

1. Cross-Border Remittances

Use Case: Remittances provide fast, low-cost international money transfers.

Example: Migrant workers will typically send funds home using money transfer services like Western Union, now they can use Bitso (Mexico) or Strike (El Salvador).

2. Trading & Arbitrage

Use Case: Stablecoins can provide a safe haven to users during crypto market volatility. Traders will use stablecoins (e.g., USDT, USDC) to enter or exit from various positions or assets without dealing with the cumbersome exchange of fiat currency.

Example: When crypto exchanges provide trading pairs as BTC/USDT it lowers traders exposure to price volatility swings vs simply trading against fiat.

3. Inflation Hedge

Use Case: Riding through hypenflation or weak currency by preserving wealth.

Example: Argentinians or Venezuelans can convert their savings into stablecoins to protect their savings from falling with their local currency.

4. Decentralized Finance (DeFi)

Use Case: Earning interest, borrowing, or lending on decentralized alternatives such as Aave or Compound.

Example: Users can deposit USDT into these platforms to earn yield or provide collateralized loans without going to a bank.

5. E-Commerce & Payments

Use Case: Merchants accept stablecoins for easy conversion and less fees for merchants and consumers.

Example: Shopify stores hosting a integration of Crypto.com Pay, or Crypto debit cards (such as Coinbase Card) for everyday purchases and payments.

6. Payroll & Freelance Work

Use Case: Companies pay employees or independent contractors in stablecoins for business.

Example: Remote teams paying salaries in USDT through Bitwage, and employees up getting paid faster and avoiding delays from their bank.

7. Charity & Donations

Use Case: Providing aid where it is needed with transparency for charities and NGOs.

Example: Charitable organizations and NGOs including UNICEF CryptoFund and The Giving Block that have provided stablecoin donations for disaster relief campaigns.

8. Gaming & virtual assets

Use case: in-game transactions or actually being able to trade your digital assets with price certainty

Example: Axie Infinity players earning stablecoins from the game or buying NFT’s

9. Smart Contracts & Automation

Use case: programmable payments for subscriptions, escrow or royalties.

Example: Artists receiving automatic USDC royalties through NFT platforms like SuperRare

10. Micropayments & monetizing content

Use case: enabling tiny payments for digital content (e.g. articles, video).

Example: Creators can use Brave Browser’s BAT token (pegged to USD) for tips

11. Supply Chain & trade finance

Use case: settling invoices across borders while reducing forex risk.

Example: Exporter/importer paying suppliers directly with USDC

12. Derivatives & hedging

Use case: collateralising crypto derivatives, hedging or protecting yourself against volatility.

Example: Platforms like dYdX offer futures trades backed by stablecoins.

13. Capital control evasion (grey area)

Use case: circumvent strict financial regulations.

Note: citizens in countries like Nigeria or China are utilizing stablecoins to move money offshore for this particular purpose, and while this would typically fall under capital control regulations, it does seem to be ignored by regulators for now.

14. Savings & deposit accounts

Use case: earning higher yields than traditional banks.

Example: Celsius Network (pre-bankruptcy) offered up to 10% apy on USDC deposits.

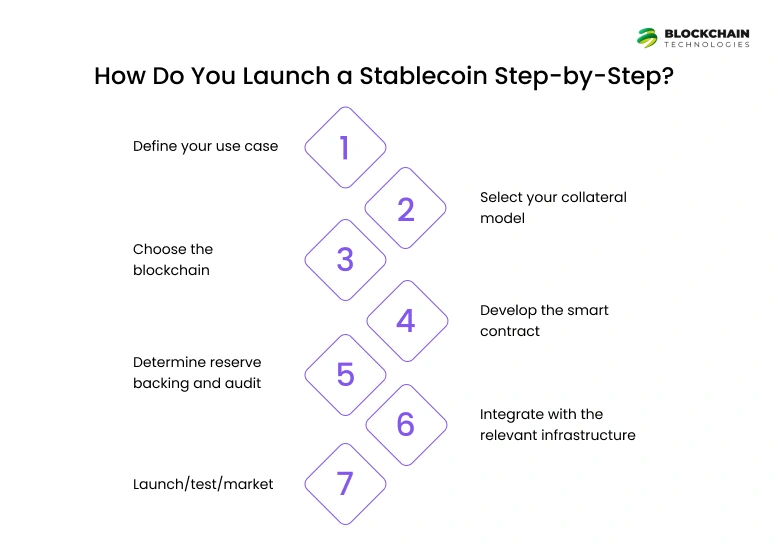

How Do You Launch a Stablecoin Step-by-Step?

- Define your use case: What problem are you trying to solve? Is it payment friction, cross-border transfers, or DeFi integration?

- Select your collateral model: Will it be Fiat-backed, crypto-backed, or algorithmic?

- Choose the blockchain: Will it be Ethereum for security, BSC for low fees, or a different chain to fit your intended collateral model?

- Develop the smart contract: Code the criteria for minting, burning, and governance.

- Determine reserve backing and audit: Transparency is key for building trust—without it, no one will buy your stablecoin.

- Integrate with the relevant infrastructure: Wallets, exchanges, payment processors.

- Launch/test/market: Go live and push your project to the identified market.

Real-Life Stablecoin Creation Examples for Businesses:

To better contextualize the process, let’s look at a handful of real or hypothetical examples:

1. Xend Finance- African E-commerce & DeFi Wallet (Nigeria)

- Stablecoin(s) used: BUSD, USDC

- Network: Binance Smart Chain

Xend Finance is a Nigerian fintech company that provides a DeFi savings and e-commerce wallet service. Within the platform they use BUSD and USDC as stablecoins to have users save in stable currencies and avoid the volatility of the naira. The platform allows mobile wallets and allows on and off ramping in local currency, allowing users to transact and save in crypto without the hindrance of inflation. Community outreach and education is part of their engagement with users.

2. Reserve – Latin America Stablecoin Payroll & Payments Platform

- Stablecoin: RSV (Reserve Stablecoin)

- Company: Reserve.org

- Region: Argentina, Venezuela, Colombia, etc

- Network: Ethereum (future plans for Layer 2 scaling)

Reserve is a blockchain-based platform running on Ethereum issuing the RSV stablecoin backed by a basket of stable financial assets. Reserve is primarily used across Latin America, but especially in Argentina and Venezuela, to counteract the effects of strong local currency devaluation. Companies and businesses are utilizing Reserve to facilitate payroll and pay remote employees in USD-backed RSV, thus avoiding dealing with hyperinflation. Reserve also offers APIs to facilitate payroll, in addition to offering integration into the savings and DeFi earning options.

3. StraitsX – Southeast Asian Fintech Stablecoin

- Stablecoin: XSGD (Singapore Dollar-pegged stablecoin)

- Company: StraitsX (by Xfers)

- Network: Ethereum, Zilliqa

StraitsX, a Southeast Asian fintech startup, issues XSGD, a stablecoin backed 1:1 by Singapore Dollars held at licensed financial institutions. They mint XSGD as deposits are received and burn the XSGD when the stablecoin is redeemed. XSGD is used for remittance, DeFi, and trading in the region, with the support of large wallets and various DeFi protocols for accessibility and liquidity. They conduct regular audits so that users can be sure that the US dollars backing the XSGD are preserved.

4. Tether Gold - Gold-Backed Stablecoin (Switzerland)

- Stablecoin: XAUT (Tether Gold)

- Company: Tether

- Network: Ethereum, TRON

Tether is best known for its USDT stablecoin, but it also issues XAUT, a token value-linked to physical gold. Each token is the equivalent of one troy ounce of gold sitting in a vault located in Switzerland. Investors can hold their gold in a non-physical form or even redeem the token for the actual physical gold. The product is fully compliant with Swiss regulations, and regularly audited which should bolster trust with commodity-backed digital asset investors.

Need help building your first stablecoin?

We build secure, scalable, and regulation-ready tokens.

Wrapping Up: Why Stablecoin Creation Matters More Than Ever

Stablecoins are no longer just a term in the crypto world — they are innovating the movement of money in a digital-centered economy. From simplified remittance and payments to participation in decentralized finance (DeFi), stablecoins are now a true use-case for real-world financial problems. While traditional cryptocurrencies are still being challenged by volatility, stablecoins offer businesses and users a reliable, scalable option.

At BlockchainTechnologies, we understand how to develop a stablecoin. Whether it be compliance, smart contract design, integration of assets, or auditability, we can help you in the process. Whether you are a fintech startup, a payments platform, or an enterprise venturing into the space of digital assets, we can help you de-risk your stablecoin project.

The time is now. Creating a stablecoin is not just for crypto giants anymore — but for cutting-edge businesses willing to become leaders of the next financial system.

Partner with a cryptocurrency development company you can trust. Let’s build the future, together.

Ready to make your stablecoin idea a reality?

Whether you’re building a stablecoin for your fintech startup or adding a tokenized payment layer to your enterprise, BlockchainTechnologies is your trusted partner in stablecoin creation, token development, and Web3 strategy.

FAQs

Launching a stablecoin in Australia requires AML/CTF compliance, transparent reserve documentation, and alignment with ASIC’s token-mapping rules. Depending on your structure, you may also require licensing for issuing asset-backed or e-money–like tokens. Businesses must maintain audited reserves and follow strict consumer-protection disclosures.

The cost to build a stablecoin typically ranges from USD $5,000 to $50,000+, depending on the reserve model, number of chains supported, security audits, regulatory needs, and liquidity setup. Algorithmic or hybrid models may cost more due to complex peg-stability coding and oracle integrations.

A stablecoin requires mint/burn logic, multisig access control, oracle integration, pausable emergency functions, and compliance modules. Most stablecoins are built on Ethereum, Polygon, Solana, BNB Chain, or Base using Solidity or Rust. Enterprise-grade contracts must undergo full audits before deployment.

Peg stability relies on well-designed mint/burn mechanics, reserve transparency, deep liquidity pools, market maker partnerships, arbitrage incentives, and reliable price oracles. Many issuers deploy circuit breakers, de-peg detectors, and emergency collateral top-up rules to protect the peg during volatility.

Issuers must provide monthly attestations, quarterly financial audits, segregated custody, and real-time dashboards showing assets backing the stablecoin. Audits are typically conducted by top firms such as Deloitte, BDO, or KPMG. Transparency directly influences user trust and adoption.

Yes—if the model uses crypto-collateralization or an algorithmic balancing mechanism. However, these models require on-chain collateral, liquidation rules, stronger peg-defense logic, and significantly more risk monitoring compared to fiat-backed stablecoins.

A fiat-backed stablecoin with cash and short-term treasury reserves is safest due to regulatory clarity, predictable value, and strong public trust. Hybrid models also offer safety but require advanced compliance and risk frameworks. Algorithmic stablecoins carry the highest risk.

Ethereum, Polygon, Base, Solana, Avalanche, and BNB Chain are the most widely used for stablecoins. They offer strong liquidity rails, DeFi integrations, security guarantees, and global ecosystem support. Multi-chain expansion is recommended once liquidity stabilizes.

Stablecoin issuers typically earn through reserve yields (e.g., treasury bill interest), mint/redeem fees, liquidity pool fees, institutional payment partnerships, and optional staking or yield products. Revenue depends on supply size, reserve composition, and on-chain activity.

To list a stablecoin, you need liquidity partners, DEX pools, market makers, compliance documentation, and published audits. Most issuers begin with Uniswap or Curve pools, then onboard CEX partners. A liquidity bootstrapping program is recommended to establish early peg stability.