Real World Asset Tokenization Platform Development

Transform real-world assets into secure, tradable digital tokens with our Real World Asset Tokenization Platform Development Services. From real estate and commodities to art and collectibles, we provide end-to-end solutions for seamless, compliant, and transparent asset digitization.

What is Real World Asset Tokenization?

Real World Asset Tokenization is the process of converting real-world assets, such as real estate, art, commodities, and other tangible assets, into digital tokens on a blockchain or similar technology. Tokenizing the asset has the potential to revolutionize the way we invest and manage assets.

By enabling fractional ownership, tokenization makes it possible for investors to buy and sell smaller portions of assets, reducing the barrier to entry for many investments. This could lead to increased liquidity, as assets that were previously illiquid can now be easily bought and sold.

Ready to see How Real World Asset Tokenization Works

Experience how our platform turns physical assets into secure, tradable digital tokens. Scalable. Compliant. Proven.

Different Assest Classes that We can Tokenize

- Residential & Commercial Properties.

- REITs & Rental Income Streams.

- Land & Infrastructure Projects.

- Gold, Silver, & Precious Metals.

- Oil, Gas, & Energy Assets.

- Agricultural Produce.

- Bonds & Debts.

- Stocks & Equity Shares.

- ETFs & Mutual Funds.

- Paintings & Sculptures.

- Rare Wines & Vintage Cars.

- Antiques & Luxury Watches.

- Music, Films, & Digital Content Rights.

- Patents & Copyrights.

- Licensing & Brand Royaltiesl.

- Startup Investments.

- Private Company Shares.

- Fundraising & Crowdfunding.

- Renewable Energy Projects (Solar, Wind, Hydro).

- Toll Roads & Public Infrastructure.

- Utility & Power Grid Investments

- Tokenized Ownership in Sports Teams.

- Concert & Event Ticketing.

- Fan Engagement & Revenue Sharing.

Comprehensive Real World Asset Tokenization Services Built for the Real World

Token Strategy & Design

We construct customized token models tailored to the unique value and attributes of your assets, while aligning with regulation and the market for successful tokenization.Smart Contract Programming

Our experienced team writes custom smart contracts that automate compliance, control token behavior, and provide a direct, secure, rules-based digital asset management solution on the blockchain.Asset Ecosystem Security Audits

To protect your digital asset ecosystem, we conduct multi-layer security assessments and vulnerability scans to help you maintain a resilient, compliant, and secure stack.Blockchain Network Integration

We help you connect your tokenized platform to strong blockchain networks to ensure interoperability, scalability, and market access through proven integration strategies.Platform Deployment & QA Testing

We comprehensively test and deploy your platform in a sandbox environment to ensure consistency prior to launch and performance across different use cases and market conditions.Post-Launch Maintenance & Optimization

Our maintenance services provide you with ongoing technical support and updates for your platform, helping you keep pace with emerging technologies and business needs.Unlock New Investment Avenues Through Asset Tokenization

Discover how our secure, scalable tokenization solutions help you maximize asset value, attract global investors, and increase liquidity.

Strategic Benefits of RWA Tokenization for Your Business

Real World Asset (RWA) tokenization offers several business benefits:

Increased Market Liquidity

Enable fractional ownership, allowing more investors to participate.Global Access to Investments

Attract investors worldwide with borderless asset trading.Enhanced Security & Transparency

Leverage blockchain for immutable records and trust.Automated Transactions

Smart contracts reduce manual processes, improving efficiency.Regulatory Compliance

Implement KYC/AML and legal frameworks to ensure compliance.New Revenue Streams

Earn through transaction fees, listing charges, and premium services.Trusted Token Standards for Secure and Scalable Asset Tokenization

At BlockchainTechs, we utilize industry-leading token standards across top blockchain ecosystems to

deliver secure, interoperable, and regulation-ready tokenization solutions.

ERC-20

The most widely adopted standard for fungible tokens, ensuring compatibility with major wallets and exchanges.ERC-721

Perfect for tokenizing unique assets such as individual properties or collectibles with NFT functionality.ERC-1400

Security token standard with built-in compliance tools like KYC/AML and transfer restrictions.ERC-1155

A flexible multi-token format that supports both fungible and non-fungible asset classes in a single contract.ST-20

Polymath’s regulatory-friendly token standard for creating compliant digital securities.BEP-20

Binance Smart Chain’s low-fee standard for fast, scalable asset tokenization.TRC-20

TRON-based token standard enabling rapid, efficient, and cost-effective asset transactions.Tezos FA1.2

An energy-efficient option for tokenizing fungible real-world assets with minimal environmental impact.Tezos FA2

A powerful, multi-asset token standard supporting advanced tokenization of a wide range of real-world assets.Globalize Your Assets with Secure Tokenization

Empower your business with borderless investments and real-time liquidity — all through transparent and compliant tokenization solutions.

RWA Tokenization Platform Development Process

01

Market Research and Analysis

In the initial stage, we identify suitable real-world assets for tokenization and we understand regulatory requirements and assess market demand.

02

Conceptualization and Planning

In the second stage we define project objectives and technical requirements and we develop a detailed project plan with timelines and resources.

03

Legal and Regulatory Compliance

We will ensure compliance with securities regulations. We will be establishing necessary legal structures and obtain required licenses.

04

Platform Development

In this phase we develop the frontend and backend components of the ICO platform. At Blockchain Technologies we create user-friendly interfaces for investors to participate in the token sale, view project details, and manage their accounts etc.

05

Investor Onboarding

In this process we create user accounts and implement KYC/AML procedures. Provide educational support and facilitate investor participation.

06

Tokenization Process

In this process we define asset selection criteria and due diligence processes. Tokenize assets onto the platform using blockchain technology.

07

Market Launch

In the 7th phase we conduct beta testing and gather feedback and if there are no issues in the platform we will launch the platform.

08

Ongoing Maintenance and Support

We will monitor platform performance and security and we provide continuous updates and customer support.

Key Features of an RWA Tokenization Platform

Tokenization & Asset Management

- Fractional Ownership

- Asset Digitization

- Smart Contract Integration

Security & Compliance

- KYC/AML Verification

- Regulated Token Standards

- Custodial & Non-Custodial Wallets

Marketplace & Liquidity Solutions

- Built-in Trading Platform

- Liquidity Pools

- Instant Settlements

Investor & Issuer Dashboard

- User-friendly Portfolio Management

- Automated Dividend & Yield Distribution

- Multi-Currency & Crypto Support

Governance & Transparency

- On-Chain Voting & Decision-Making

- Immutable Audit Trails

- Multi-Signature Authorization

Interoperability & Integration

- Blockchain-Agnostic Development

- API & Third-Party Integrations

- DeFi & NFT Compatibility

Case Study of our recently Developed RWA Tokenization Platform

EOS500 is a game-changer in the real estate industry, offering a platform where anyone can easily tokenize their real estate property. It’s like turning real estate into digital assets, making it simpler for people to invest and trade. With EOS500, owning a piece of property becomes more accessible to everyone, breaking down barriers and opening up new opportunities for investment.

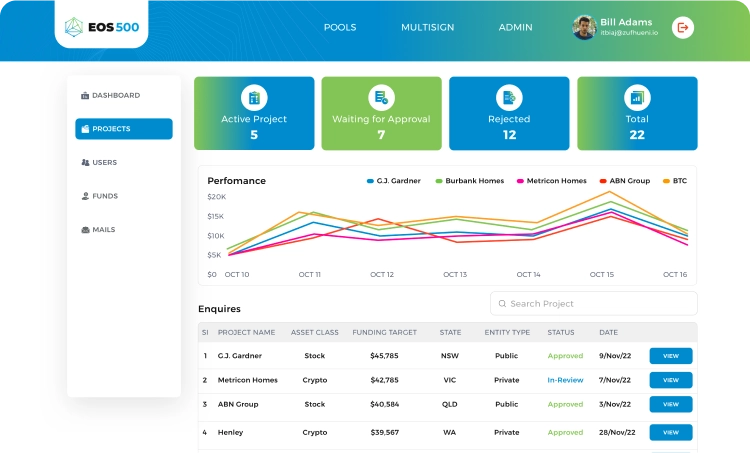

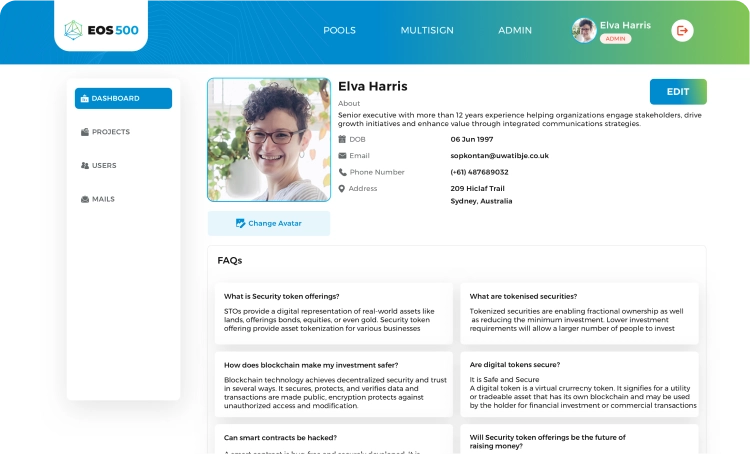

In the super admin dashboard, the super admin has a clear and comprehensive view of various aspects related to projects and user information. This enables the super admin to effectively manage and oversee the platform's activities.

The projects section of the dashboard provides a range of insights into the current status of projects on the platform. This includes Active Projects, Projects Waiting for Approval, Rejected Projects, Total Project.

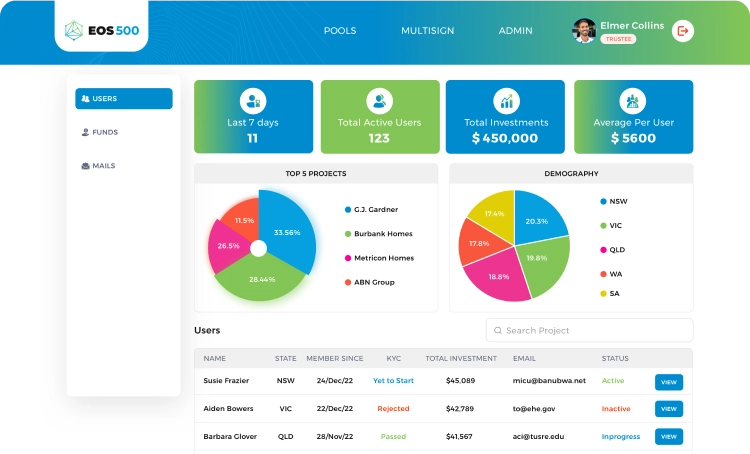

In the user information section of the dashboard, the super admin can view various metrics related to user engagement and investment. This includes, Users in Last 7 Days, Total Active Users, Total Investment, Average Investment per User.

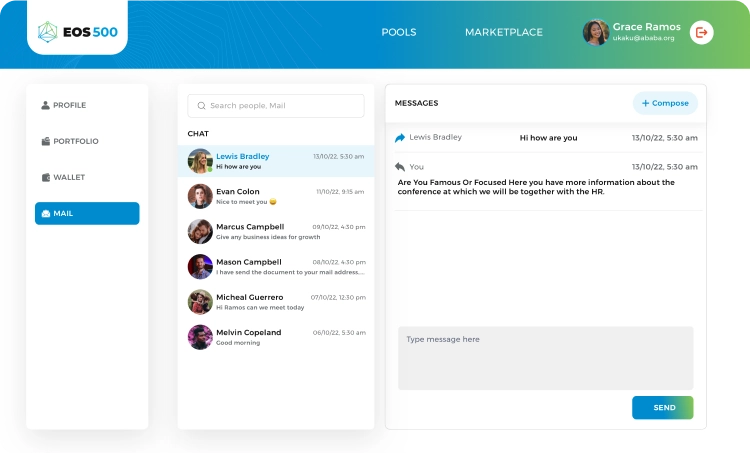

Admin can see the status of all projects, like those that are active, waiting for approval, and rejected, on the platform. Admin can also see details about users, such as the number of users who joined in the last 7 days, total active users, total investment, and average investment per user. Apart from this, the admin can also talk to users through mail chat. This helps the admin to manage the platform better and also communicate with users easily.

Trustee has the access to examine the specifics of the funds held within the trust, such as the types of investments, account balances, or any other relevant financial information related to the users Total Investments etc.

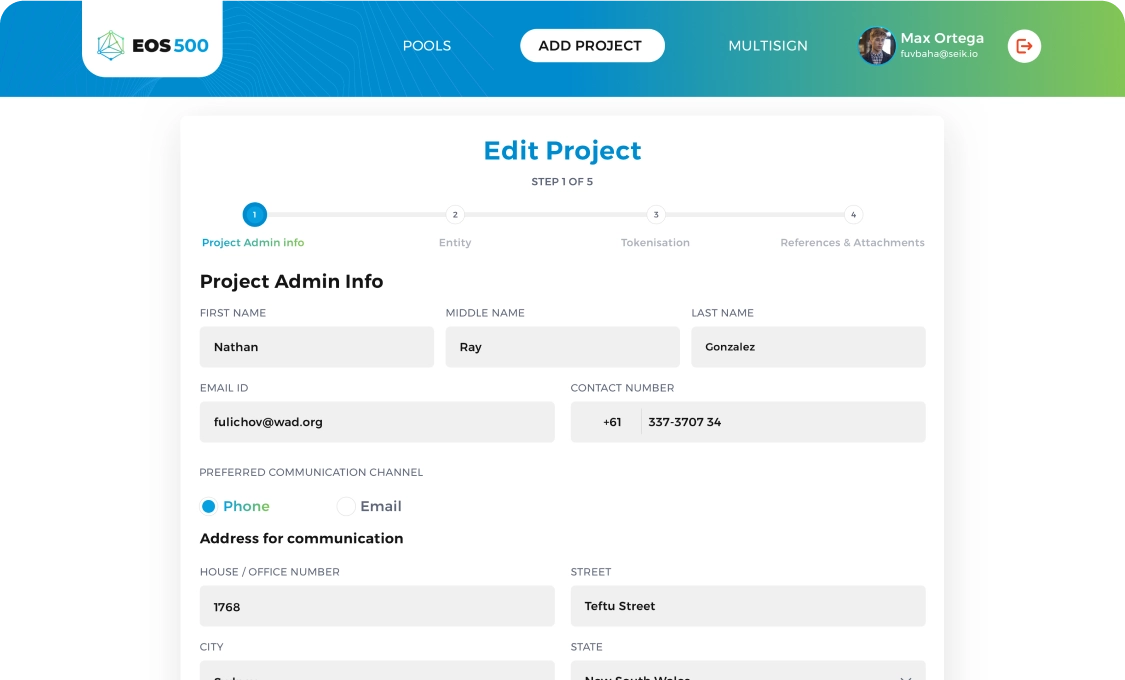

Project owners can list their projects on the platform by providing necessary details, such as project admin information, entity details, tokenization information, and references or attachments. After the project is added, it undergoes a review process where the super admin checks and verifies the provided information before approving the project for public viewing and trading on the platform.

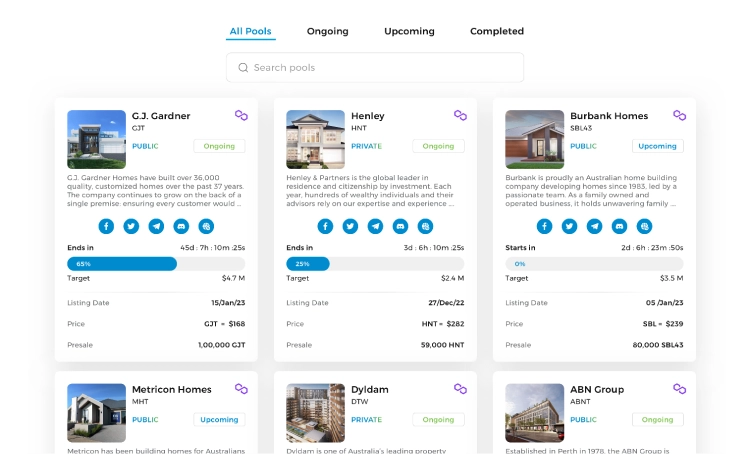

The listing pool is an important feature that allows users to easily browse assets that are available for purchasing on the platform. By providing key details such as the listing date, price, and presale information, the listing pool helps users to take decisions about which assets to buy.

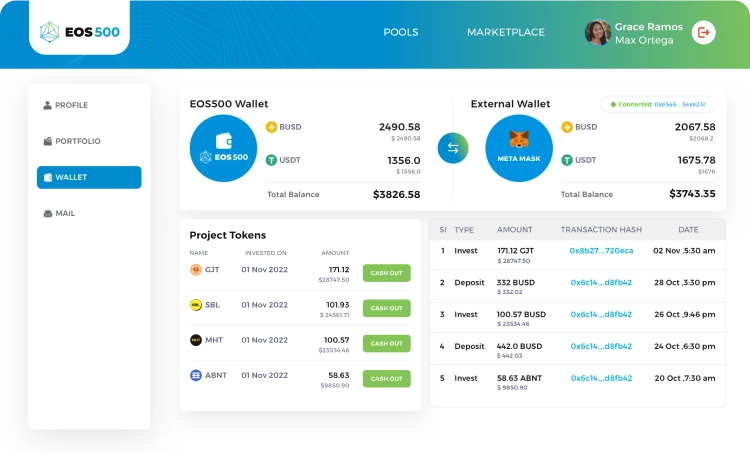

Investors can view of their investments, including details such as Total Investments and total earnings. Additionally, these apps often come equipped with built-in wallet functionalities, allowing investors to manage their financial assets and transactions seamlessly within the app.

EOS 500 includes an in-built chat function, enabling seamless communication and collaboration among users. This feature enhances the overall user experience by facilitating real-time interaction and increases a sense of community.

With the in-built wallet, users can easily make payments using Crypto coins and FIAT. This feature ensures a seamless and secure user experience, as all transactions are encrypted and protected. By integrating the in-built wallet, we aim to simplify financial management and streamline the payment process.

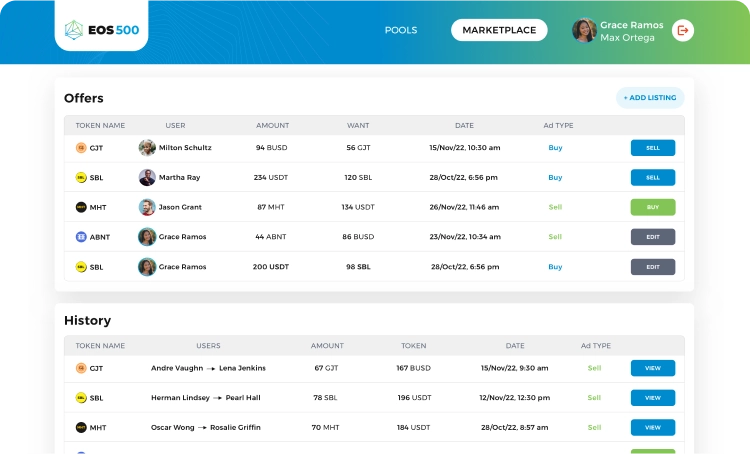

In the offer listing, users can post about their desire to buy or sell cryptocurrency coins or fiat currencies. To do this, they can add their offer to the listing. If someone wants to buy or sell cryptocurrency coins or fiat currencies, they can do so by browsing the listings and selecting an appropriate offer. This creates a convenient and streamlined process for buying and selling digital and traditional currencies.

Trusted by Leading Enterprises for Smart Asset Tokenization

Join the ranks of forward-thinking businesses transforming asset ownership and expanding investor networks with our end-to-end tokenization services.

Got questions? We have answers!

RWA tokenization is the process of converting real-world assets—such as real estate, commodities, or financial instruments—into digital tokens on the blockchain. These tokens represent ownership or claims on the asset, making them easily tradable, accessible, and divisible.

Tokenization provides several benefits, including increased liquidity through fractional ownership, broader accessibility for global investors, improved transparency via blockchain traceability, reduced transaction costs by cutting intermediaries, and faster settlements using smart contracts.

Previously illiquid assets like real estate or fine art become divisible and tradable on blockchain exchanges. Fractional ownership lowers entry barriers, enabling more investors to participate and improving market liquidity and accessibility.

Leading platforms include Ondo Finance (tokenized U.S. Treasury access), Maple Finance (institutional RWA access), Securitize (regulated securities including bonds), and Backed Finance (tokenized government bond products).

Popular blockchains supporting RWA tokenization include Ethereum (smart contracts), Polygon (low fees and scalability), Avalanche (fast performance), and Polkadot (cross-chain compatibility).

Tokenization allows for fractional ownership, making high-value assets accessible to more people. Ownership records are updated automatically on the blockchain, eliminating intermediaries and enabling fast, secure, and efficient transfers.

Transparency is a core benefit of RWA tokenization. Blockchain technology ensures all transactions are permanently recorded, enabling real-time auditing, reducing fraud, and building investor trust.

Steps include: 1) selecting a suitable asset (e.g., real estate or art), 2) ensuring legal compliance, 3) developing smart contracts, 4) creating tokens that represent ownership, and 5) listing them on a security token exchange or private marketplace for trading.

Examples include: Real estate (residential/commercial), commodities (gold, oil), financial instruments (bonds, stocks), intellectual property (royalties, patents), and luxury items (art, collectibles, rare wines).

Tokenization increases asset value by improving liquidity and global accessibility. It simplifies custody through digital ownership records, reducing the reliance on traditional custodians, and requires strong legal frameworks and secure smart contracts to ensure compliance and protection.

Connect With Us

Send us your requirements and our team will get back to you shortly

Our Locations

Sydney

MLC Centre, 19-29 Martin Place,

Sydney, Australia 2000

Perth

56 Palmerston St, Perth-WA,

Australia 6000

Dubai

Binary Tower, 20th Floor, Office 96,

Business Bay, Dubai, UAE

Melbourne

14 Mason Street, Melbourne,

VIC, Australia 3175

Chennai, India

Level 7, 143, MGR Main Rd, Perungudi,

Chennai, India 600096

Brisbane

80 Ann, Brisbane, QLD,

Australia 4000

Sydney

MLC Centre, 19-29 Martin Place,

Sydney, Australia 2000

Perth

56 Palmerston St, Perth-WA,

Australia 6000

Dubai

Binary Tower, 20th Floor, Office 96,

Business Bay, Dubai, UAE

Melbourne

14 Mason Street, Melbourne,

VIC, Australia 3175

Chennai, India

Level 7, 143, MGR Main Rd, Perungudi,

Chennai, India 600096

Brisbane

80 Ann, Brisbane, QLD,

Australia 4000