Stablecoins in DeFi: Powering the Decentralized Economy

May 19,2025

Stablecoins in DeFi: Powering the Decentralized Economy

Stablecoins are now the backbone of decentralized finance (DeFi), working to link traditional finance and the managed chaotic world of crypto through tactical tethering of stable or predictable fiat currencies or commodities. They have injected some predictability back into everyday transactions, lending, and yield farming by providing an alternative mechanism of value that has core blockchain advantages: decentralization, transparency, and cross-border access.

Understanding how to integrate stablecoin mechanisms is critical for tech startups and enterprises that want to build Web3 solutions. This blog will explore how stablecoins fuel DeFi, where they fit into protocols, and how we help companies utilize Stablecoins and stablecoin models in financial innovation at scale, while staying compliant!

What Are Stablecoins in DeFi & Why They Matter?

Stablecoins are digital assets whose purpose is to reduce price volatility by pegging their value to stable assets, including fiat currency, commodities, or algorithms. Stablecoins capture all the advantages of cryptocurrency, including fast transactions, decentralized character, and the benefits of traditional currencies, including stability.

Types of Stablecoins: Mechanisms and Use Cases

1. Fiat-Collateralized Stablecoins

Mechanism: Reserves (for example, USD, EUR) held in regulated banks that back 1:1.

Examples:

- Tether (USDT): Owns 60% of the stablecoin market ($141B+ market cap), but has been scrutinized for its reserves.

- USD Coin (USDC): Fully audited and governed by the Centre Consortium, a great showcased example for businesses that need to abide by compliance.

Use case : It includes cross-border payments, payroll systems, and liquidity pools.

2. Crypto-Collateralized Stablecoins

Mechanism: Overcollateralized with cryptocurrencies (e.g., ETH, BTC) to reduce volatility.

Examples:

- DAI (MakerDAO): Decentralized, backed by Ethereum, $5B+ in collateralized debt positions (CDPs)

- EOSDT: Uses EOS and BTC collateral for better liquidity.

Use Case: Decentralized lending/borrowing and hedging against crypto volatility.

3. Algorithmic Stablecoins

Mechanism: Adjusts supply algorithmically using smart contracts (no collateral).

Examples:

- Ampleforth (AMPL): Rebase supply every day adjustment based on demand.

- Frax (FRAX): Hybrid model that combines collateral and algorithmic adjustments.

- Risk: Collapse of TerraUSD in 2022 ($60B loss) highlights fragility of market confidence in a stablecoin.

4. Commodity-Backed Stablecoins

Mechanism: Pegged to gold or other physical assets (PAXG, DGX, etc.)

Use Case: Inflation hedge and store of value in emerging markets

Ready to Build the Future of Finance?

Whether you’re launching a DeFi lending platform, integrating stablecoins, or building a cross-border payment system, Blockchain Technologies is here to accelerate your journey with secure, scalable, and compliant solutions.

Stablecoins in DeFi: Core Applications

1. Liquidity Provider & Automated Market Makers

Why it matters:

Stablecoins like USDC and DAI act as the primary liquidity in on-chain liquidity pools (for example, on Uniswap and Curve Finance) by providing continuous trading opportunities with low slippage – for example, Curve’s stablecoin pools alone, process over $2B of daily volume and near-1:1 swappable stablecoins.

Our Integration Tip:

The use of multi-chain stablecoins (e.g., you can use USDC on both Ethereum and Solana) is a great way to minimize gas fees and also improve cross-protocol (frame?) interoperability for blockchain integration.

2. Lending and borrowing

In tools like Aave and Compound (protocols), interest rates vary by demand and they were stablecoins that cash for under collateralized loans. For example, DAI facilitates over $12B loans every year as stablecoins. Check out our guide on launching a crypto lending platform

3. Yield farming & staking

Stablecoins help to mitigate the potential impermanent loss when yield farming. Platforms like Yearn Finance allow users to deposit stablecoins and grant access to the capital across a number of protocols, maximizing yield farming opportunities, and auto-compounding returns; current returns can be as high as 15% APY. Get a guide for top defi staking platforms.

4. Cross-border payment

Stablecoin payments reduce remittance fees by as much as 80% compared to a traditional method. Mural Pay connects companies and individuals in a number of countries including Brazil and Japan, uses USDC for immediate settlement and reduced forex fees. Read more about Cross-Broder Payment services.

The Importance of Stablecoins in DeFi Platforms

If you are a tech startup, entrepreneur, or enterprise entering into DeFi markets, integrating stablecoins is necessary for platform stability and trust from users. Key aspects to understand include:

- Integrated into Liquidity Pools: by integrating Stablecoins into liquidity pools, you are basically guaranteed consistent trading pairings to minimize slippage.

- Smart Contract Compatibility: Stablecoins should be able to work with platform smart contracts for better transactions.

- Regulatory Compliance: Make sure you are compliant with legal standards when adding fiat-collateralized stablecoins.

Challenges & Risks to Stablecoin Adoption: Regional Overview (US, EU, AU, UK, Asia)

Stablecoin adoption faces different challenges based on regional regulatory fragmentation, market risks, and geopolitical priorities. Below is a detailed overview of some of the major risks surrounding stablecoin adoption in the U.S., EU, Australia, UK, and Asia:

1. United States

Regulatory Fragmentation

- Numerous Oversight Regimes: The SEC considers some stablecoins to be securities, while the CFTC considers some stablecoins to be commodities and the OCC and FDIC regulate with a focus on integration into the banking system. Constantly changing risks for issuers of stablecoins.

- Uncertainty in Legislative Environment: The Lummis-Gillibrand Payment Stablecoin Act (2024) proposes federal oversight, yet contradicts state frameworks, notably New York's BitLicense.

- Regulatory Headwinds Associated with the STABLE Act: Requires stablecoin issuers to acquire banking charters which increases barriers for traditional and decentralized projects.

Market Risks:

- Depegging Events: USDT temporarily lost its peg (to as low as $0.97) during the 2023 crisis highlighting liquidity risks.

- Algorithmic Risks: The demise of TerraUSD exposed $60B worth of systemic risks associated with unbacked stablecoins.

2. European Union

Severe Conformity Requirements

- MiCA Regulation: Bans algorithmic stablecoins and requires fiat-backed tokens to have 1:1 reserves. Issuers need to register as electronic money institutions (EMIs).

- Delisting Non-Compliant Stablecoins: Exchanges including Binance and Kraken removed USDT and EURT from trade for EU users, fragmenting liquidity.

Concerns of Monetary Sovereignty

- Economic Threats to Euro: EU authorities caution that global stablecoins such as USDT may threaten the euro's position in payment and monetary policy.

- CBDC Initiative: The ECB has given priority to the development of the digital euro, but is bunched with private stablecoins in a public-sector payments system.

3. Australia

Emerging Regulatory Gaps

- Limited Oversight: The RBA acknowledges stablecoins pose limited systemic risks for the time being. They caution that this could change if they grow rapidly and cause a disruption to the payments and banking sectors.

- Protecting Consumers: Risks include (1) reserve management issues or obfuscation (similar to Tether’s history); (2) migrating risks with smart contracts (which expose investors in DeFi ecosystems).

Market Unpreparedness

- Low Adoption: TrueAUD is the largest AUD-pegged stablecoin with a market cap of enough to obtain ~A$40M, which suggests limited institutional confidence.

- Regulatory Delay: The Council of Financial Regulators (CFR) is still developing and finalizing that a framework specifically for payment stablecoins.

4. United Kingdom

Financial Stability Risks

- BoE Warnings: The Bank of England has identified risks posed by offshore sterling-pegged stablecoins that are backed by illiquid assets and create an incentive to offload those assets in the event of market stress.

- Currency Substitution: The increasing presence of USD-backed stablecoins (e.g., USDC) may dilute the role of GBP for transactions in the domestic market.

Regulatory Lag

- Slow Legislative Progress: The UK is behind the EU, which has a MiCA framework. The UK will only likely publish stablecoin rules by 2026, further delaying institutional uptake.

- Capital Treatment: The PRA’s current treatment of cryptoassets with 100% risk weighting means stablecoins would be unattractive for banks.

5. Asia

Regulatory Disparity

- Strong Standards in Singapore: MAS requires full reserve audits and 5-day redemption guarantees for stablecoins, including XSGD 510.

- China's Ban: Conservatively prohibits all private stablecoins, and regulates the state-controlled digital yuan 1015.

Market Volatility & Dependency

- Algorithmic Failures: The collapse of TerraUSD affected Asian markets, damaging the credibility of decentralized economic models 10.

- Dollar Dependency: While there are local currency initiatives (i.e. XSGD, IDRT), USD-pegged stablecoins predominate cross-border trade and expose economies to foreign exchange risk.

Access & Inclusion Issues

- Currency Crises: Stablecoins are regularly used to hedge inflation in countries like Nigeria and Argentina, but regulators push back on capital flight concerns.

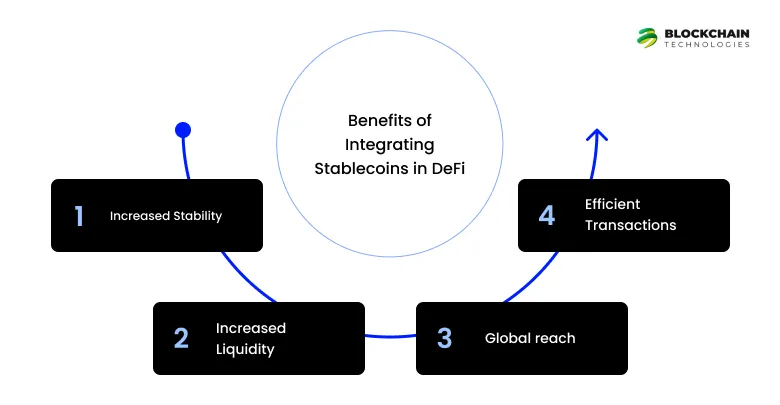

Benefits of Integrating Stablecoins in DeFi

- Increased Stability: Reduces volatility often found in cryptocurrencies, leading to confidence for users.

- Increased Liquidity: Less likely to have price fluctuations means users are more likely to enter the market, improving liquidity on the platform.

- Global reach: Users can transact/participate in DeFi from anywhere, without risk to their local currency.

- Efficient Transactions: Transactions are faster and cheaper than the existing banking systems.

Real-World Use Cases & Real-Time Examples of Stablecoins in DeFi

1️. Lending & Borrowing Platforms

Use Case: Usage of stablecoin for lending, borrowing, and earning regular interest.

Example: Aave

- Aave supports lending and borrowing stablecoins like USDC, DAI, and USDT.

- Lenders earn interest while users borrow crypto collateral at zero risk of price volatility.

- Enterprises and protocols build yield vaults on Aave over programmatically with stablecoins.

Startup Insight: A lending feature with stablecoin integration provides reliable returns and enhances your DeFi platform’s usability.

2️. Yield Farming & Liquidity Mining

Use Case: Users provide liquidity to stablecoin pools and earn DeFi tokens or fees.

Example: Curve Finance

- Curve is an optimized low-slippage stablecoin swap.

- Offers high APY returns by staking stablecoin pairs (e.g., USDC/DAI/USDT).

- Uses AMMs optimized for stable assets to minimize impermanent loss.

Startup Insight: You can build Curve-like pools on your DeFi platform to acquire stablecoin liquidity providers.

3️. Cross-Border Payments and Remittances

Use Case: Efficient, inexpensive cross-border payments via stablecoins.

Example: Circle (USDC) + Visa Partnership

- Visa added USDC on Solana and Ethereum to use for international merchant payments.

- Businesses can pay employees, freelancers, or suppliers abroad using stablecoins and real-time settlement.

Startup Insight: Use white-label payment gateways or embedded wallets via stablecoins to automate cross-border payments.

4️. Treasury Management and On-Chain Payroll

Use Case: DAOs and Startups store and pay teams stablecoins.

Example: Gnosis Safe + Superfluid

- DAOs and Web3 startups utilize Gnosis Safe for storing stablecoins, while Superfluid is utilized to stream stablecoin payments (e.g., USDC salaries).

- Open, transparent, and programmable payroll with zero middlemen.

5. Derivatives Collateral & Synthetic Assets

Use Case: Stablecoins are used as collateral or margin for trading DeFi derivatives.

Example: Synthetix

- Stablecoins (such as sUSD) are staked to produce synthetic assets like sETH, sBTC, or synthetic forex.

- The platform uses stablecoins to secure margin stability and prevent liquidation amid market volatility.

Startup Insight: Stablecoin collateral-based derivatives platforms can reduce systemic risk and boost adoption.

Looking ahead: Stablecoins in 2030

1. Central Bank Digital Currency (CBDC)

Project: Digital Dollar Project (USA) and Digital Euro (ECB) which will intersect with DeFi by attempting to apply regulation to the efficiency of blockchain technology.

2. Hybrid Stablecoin

Innovation: Used fiat collateral while adjusting algorithmically in a way that enables scaling (example: DIBS Capital’s ERC-20 token)

3. Institutionalization of DeFi

Growth: JPMorgan has launched Onyx and Blackrock has launched a BUIDL fund – both using a USDC treasury as they step into enterprise.

4. Interoperable Solutions

Tools: Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Polkadot’s Cross Consensus Messaging (XCM) will allow transfer of stablecoins between chains to connect fragmented markets.

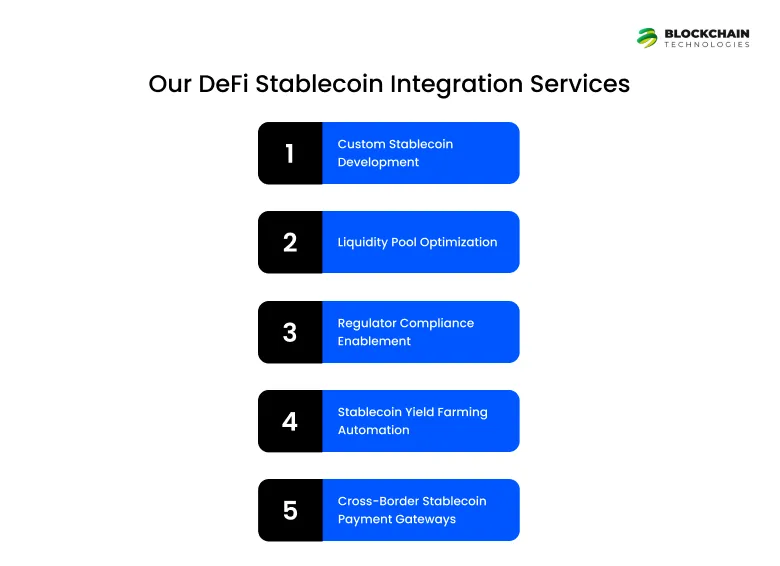

Our DeFi Stablecoin Integration Services

BlockchainTechs enables tech startups, entrepreneurs, and enterprises to build next-gen DeFi platforms with sound and seamless stablecoin integrations. Our services are built to help you scale quicker, remain compliant, and earn in the dynamic decentralized economy.

Here’s how we can help you win:

1. Custom Stablecoin Development

- Create your own stablecoins with full multi-chain interoperability.

- Build fiat backed, crypto-collateralized, or commodity pegged stablecoins that are focused on your ecosystem.

- Conduct transactions on the leading blockchains such as Ethereum (EVM chains), Cosmos, and Solana, instantly.

- Add programmable features, including automated rebalancing, on-chain reserve audits, and programmed interest paid out directly to users when applicable.

Ideal for: New DeFi platforms, payment solutions, and cross-border financial services.

2. Liquidity Pool Optimization

- Increase liquidity for your DeFi platform and protect your investors.

- Design and deploy Automated Market Makers (AMMs) and protocols that reduce impermanent loss using templates inspired by Curve Finance.

- Create stablecoin-specific liquidity pools that provide low slippage, high efficiency, and long-term stability.

- Encourage and incentivize liquidity providers by clearly communicating and implementing yield boosting strategies to reward them sustainably.

Ideal for: DEXs, lending platforms, and decentralized asset management protocols.

3️. Regulator Compliance Enablement

- Handle intricate regulations with ease.

- Create audit-able reserve management frameworks that facilitate transparency and trust for users.

- Embed KYC/AML workflows that satisfy major global regulations such as MiCA (EU), SEC (USA) and MAS (Singapore).

- Construct intelligent compliance layers that adjust based on regional legislation and can provide an optimized user experience.

Best suited for: Institutional investor-targeted projects or crypto projects expanding globally.

4️. Stablecoin Yield Farming Automation

- Build yield on stable asset deposits using automated DeFi processes.

- Launch auto-compounding vaults that yield-farm underperforming assets on chains such as Compound, Aave, and Balancer.

- Swap deposits via risk-adjusted APYs, allowing your users a better-performing deposit on their stable asset.

- Offer multi-stake layers, like low-risk stablecoin-only vaults.

Optimal for: Yield aggregators, savings protocols, and DeFi investment platforms.

5️. Cross-Border Stablecoin Payment Gateways

- Continue growing with borderless payments in seconds.

- Use white-label payment systems with stablecoins such as USDC, USDP, and upcoming CBDC’s (Central Bank Digital Currency).

- Enable merchants, payroll, and business-to-business settlements to make frictionless payments.

- Open up multi-currency support with on-chain FX and real-time exposure.

Suitable for: Fintech start-ups, global marketplaces, and enterprise payment networks.

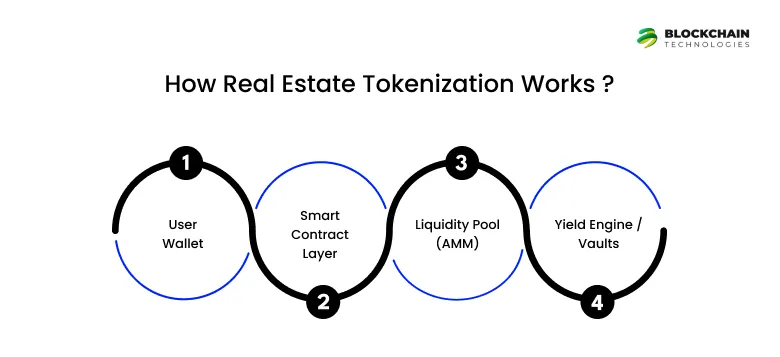

How Stablecoin Integration Works: Step-by-Step Process

Here at BlockchainTechs, we help you integrate stablecoins into your DeFi setup via robust APIs, smart contracts, and liquidity engines. Here is a bird’s-eye view of how the flow of integration typically goes:

1️. User Wallet

Users access your DeFi app through Web3 wallets (e.g., MetaMask, Trust Wallet). Our integration offers wallet connectivity through WalletConnect, Web3.js, or Ethers.js. Read our guide on Cryptocurrency wallet

Example: The user connects the wallet to your DApp and selects USDC to stak

2️. Smart Contract Layer

When the user sends a transaction (e.g., deposit, stake, swap), your platform invokes smart contracts to run the stablecoin logic.

These contracts:

- Validate the user’s token balance

- Lock or transmit the stablecoin

- Interact with yield protocols or AMMs

Example: Smart contracts verify the deposit of 500 USDC and begin vault allocation.

3️. Liquidity Pool (AMM)

The smart contract then sends the tokens to a preconfigured Automated Market Maker (AMM) or internal liquidity pool such as:

- Uniswap

- Curve Finance

- Balancer

- Custom-built AMMs

Here, users can:

- Earn trading fees as LPs

- Provide liquidity to stablecoin pairs

- Enable low-slippage trades for others

Example: 500 USDC is deposited into a USDC/DAI Curve pool that is yield-optimized.

4️. Yield Engine / Vaults

Once deposited into the pool, the system can automatically:

- Reinvest rewards (auto-compounding)

- Move funds between protocols based on APY

- Stake LP tokens into farming vaults (e.g., Yearn, Aave)

- The automation is facilitated by back-end APIs and on-chain governance logic that optimize returns and minimize risks.

Example: USDC is programmatically moved between Aave and Compound in response to prevailing interest rates.

Conclusion: Building the Future of Finance with Stablecoins

Stablecoins aren’t just speculation instruments—they are revolutionizing international finance by optimizing systems to be efficient, inclusive, and clear. For companies, integrating stablecoins into DeFi protocols breaks open liquidity, reduces costs, and taps a $204B+ market

We, blockchaintechnologies guides companies along this journey with secure, scalable stablecoin solutions. Whether launching a CBDC pilot or yield farm maximization, our expertise assists you in leading the decentralized economy charge.

Ready to Innovate? Reach Out to Us to discuss bespoke DeFi stablecoin integration solutions and stablecoin development services.

FAQs

Stablecoin integration costs depend on platform simplicity, blockchain architecture, and required features. For easy integration, costs may start from $5,000–$10,000, whereas business solutions with regulatory integration, multi-chain integration, and personalized smart contracts range up to $50,000 or more. We offer customizable packages tailored just for you.

Integration timescales depend on scope, but standard stablecoin integrations take between 3 to 6 weeks. This covers smart contract configuration, liquidity pool integration, compliance layers (KYC/AML), and testing. Quicker deployment is available for MVPs with pre-existing modules.

DeFi stablecoin integration solutions assist companies in mitigating volatility, attracting international users, and increasing liquidity. Through hassle-free integration of stable assets such as USDC or USDT, you facilitate smoother trading, lending, and yield farming experience—all with regulatory comfort.

Stablecoin utility in DeFi platforms ensures price stability, faster settlements, and lower gas fees, thereby simplifying lending, borrowing, and earning without the risk of large price volatility. It also offers access to global financial users who want to use stable assets over volatile crypto tokens.

Supporting stablecoins for DeFi protocol development encompasses smart contract integration with ERC-20 stablecoins, referencing pools of liquidity, managing collateral rates, and support for staking or farming functionality. All of these, we help implement with regulatory compliance and security audits as a requirement.