Hashgraph vs. Blockchain: A Comparative Analysis for Enterprise Solutions

May 19,2025

Hashgraph vs. Blockchain: A Comparative Analysis for Enterprise Solutions

As organizations greater utilize decentralized technologies, the conversation on Hashgraph vs Blockchain becomes louder and louder. Both of these are part of distributed ledger technology (DLT), but they support different business needs. For startups & enterprises building Web3 solutions, DLT technology is important to their efforts to scale, build security, and have a cost-effective business case. In this blog, we are going to breakdown Hashgraph vs. blockchain with consideration to performance, governance, and business capability so that you can make educated decisions for your next project.

What is Blockchain?

In simplest term, a blockchain is a decentralized, distributed ledger that is a chain of blocks, each containing a series of transactions. Here are some of the characteristics of blockchain:

- Structure: Consists of a linear chain of blocks.

- Consensus Mechanisms: PoW, PoS, etc.

- Transparency: ledgers are public.

- Security: high, from cryptographic hashing, consensus protocols.

Blockchain is intended to support cryptocurrencies such as Bitcoin and Ethereum, but has also been “applied” blockchain in supplychain, and healthcare, finance.

What is Hashgraph?

Hashgraph is a newer DLT mechanism based on a Directed Acyclic Graph (DAG). It uses Gossip about Gossip protocol and Virtual Voting for consensus, which allows for:

High Throughput: Hashgraph can handle hundreds of thousands of transactions per second.

Fairness: Hashgraph assures the order of transactions is based on the time of consensus.

Security: Hashgraph’s asynchronous Byzantine Fault Tolerance (aBFT) ensures significant security from bad actors.

Efficiency: Hashgraph is more efficient and uses far less energy than traditional blockchains.

Hashgraph also works a great deal better in situations requiring speed and fairness, such as real-time bidding and microtransactions.

Build the Right DLT for Your Business

Not sure whether Hashgraph or Blockchain fits your enterprise needs?

Let BlockchainTechs.io help you architect the perfect solution—secure, scalable, and future-ready

Hashgraph vs. Blockchain: Key Differences for Enterprises

Here we have listed out the key differences between Hashgraph and Blockchain for enterprises

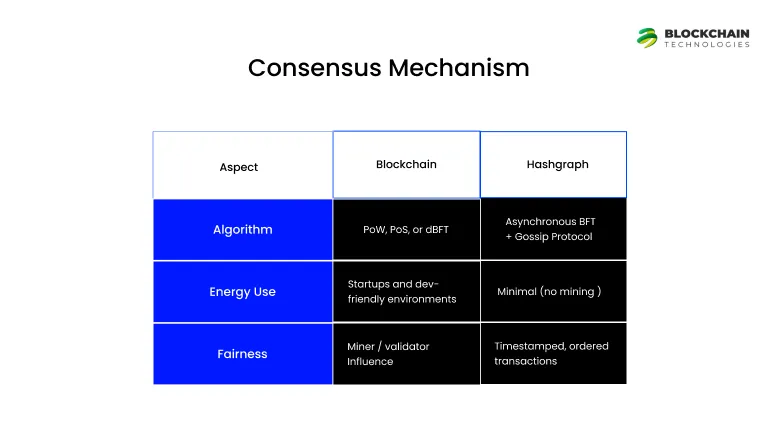

1. Consensus Mechanism

Blockchain’s PoW is energy-intensive, while Hashgraph’s aBFT ensures energy efficiency and fairness

2. Transaction speed & Scalability

Blockchain: Processes 7–50,000 tps (depending on the chain; Solana with 50k tps).

Hashgraph: Consistently with 10,000+ tps and 3–5 seconds until finality.

Hashgraph processes more than most blockchains when it comes to throughput, making it well suited for high-frequency applications like financial settlements

3. Governance & Decentralization

Blockchain: Public chains (e.g. Bitcoin) are completely decentralized; private chains (e.g., Quorum) have controlled access

Hashgraph: Public but governed through a council and blend of enterprise needs with partial decentralization. If enterprises are focused on control, private blockchains might work better for their needs. Hashgraph provides a solution if you are looking for speed & some managed oversight

4. Security & Fork Resistance

Blockchain: Vulnerable to 51% attacks (PoW chains); forks are commonplace (e.g. Bitcoin Cash)

Hashgraph: Fork proof via aBFT and virtual votes, meaning there will never be two sources of truth Hashgraph’s aBFT has better Byzantine fault tolerance than most blockchain consensus pathways

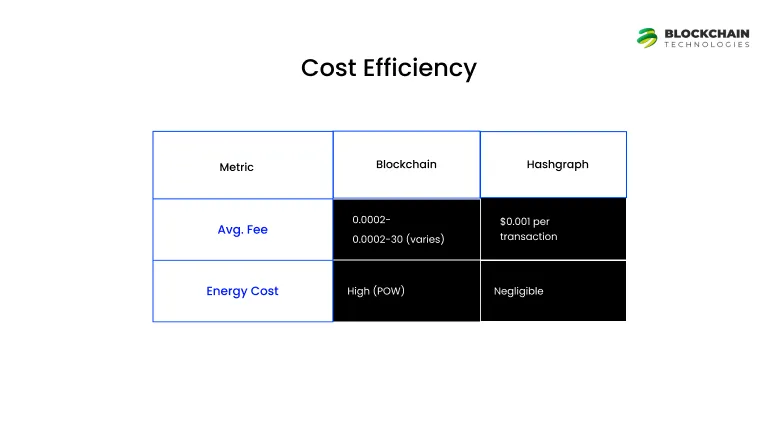

5. Cost Efficiency

While XRP (blockchain) offers lower fees, Hashgraph’s predictable pricing avoids congestion spikes

Hashgraph vs Blockchain performance comparison

Use Case Analysis

| Application | Blockchain Fit | Hashgraph Fit |

|---|---|---|

| Supply Chain | Transparent, immutable tracking | High-speed, tamper-proof auditing |

| DeFi Platforms | Trustless smart contracts | Micropayments & low-latency trades |

| Digital Identity | Self-sovereign identity solutions | GDPR-compliant, enterprise-grade |

For ESG reporting or real-time settlements, Hashgraph’s speed excels. Blockchain remains king for decentralized ecosystems like DeFi.

Factors to Consider while Choosing the Right Distributed Ledger Technology for Enterprise Use

Choosing the right distributed ledger technology (DLT) – Hashgraph versus Blockchain – is a mission-critical step for startups and enterprises launching on Web3 or decentralized applications (dapps). Your decision ultimately dictates compliance, scalability, user trust, and ROI.

Let’s explore the main considerations and implications in more detail so that you can make an informed and future-proof choice

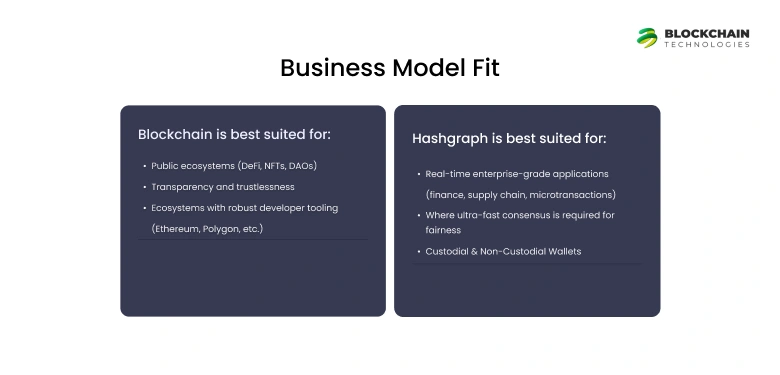

1. Business Model Fit

Before examining the technical differences, it’s essential to clarify your business goals:

- Are you creating a public decentralized platform or individual private enterprise-grade offering?

- Do you want to minimize trust, or do you need access controlled?

- Will anyone use your marketplace for high-frequency transactions, or do you want data integrity and auditability?

Blockchain is best suited for:

- Public ecosystems (DeFi, NFTs, DAOs)

- Transparency and trustlessness

- Ecosystems with robust developer tooling (Ethereum, Polygon, etc.)

Hashgraph is best suited for:

- Real-time enterprise-grade applications (finance, supply chain, microtransactions)

- Where ultra-fast consensus is required for fairness

- Where aBFT is required

2. Performance & Scalability Requirements

Performance metrics vary drastically between Blockchain and Hashgraph. Here’s how they compare:

| Metric | Blockchain (Ethereum, Bitcoin) | Hashgraph (Hedera) |

|---|---|---|

| Transactions per Second | 10–10,000 TPS | Up to 500,000 TPS |

| Transaction Finality | Minutes | 3–5 seconds |

| Network Latency | High | Very Low |

| Energy Efficiency | Low (for PoW) | High |

If your enterprise needs high-throughput, real-time processing (e.g., ad bidding, stock trading, gaming), Hashgraph clearly wins.

3. Security & Consensus Mechanism

Both technologies utilize strong consensus models but differ in several important ways:

- Blockchain can use PoW, PoS, or a hybrid mechanism, all requiring miners or validators.

- Hashgraph can use Virtual Voting and Gossip about Gossip, yielding an asynchronous Byzantine Fault Tolerance (aBFT), one of the most secure consensus protocols available today.

Enterprises where regulatory compliance, data integrity, or national security applications are paramount, will likely prefer Hashgraph for the mathematical guarantee of security.

4️. Ecosystem Maturity & Developer Tools

In ecosystem maturity, blockchain wins:

- Tens of thousands of developers, mature SDKs, mature frameworks, mature tools (Truffle, Hardhat), and mature Layer 2 scaling solutions

- Existing open-source protocols that you can fork or build on (DeFi, DAO, NFT marketplaces)

Hashgraph is newer but moving quickly, because it offers:

- SDKs in Java, JavaScript, Go and Rust

- Enterprise integrations (IBM, Google Cloud, etc.)

- Access to the Hedera Governing Council and permissioned support

If time-to-market and an existing community of developers is a higher priority, choose Blockchain. If next-gen scalability and you’re building from the ground up, choose Hashgraph.

5. Governance & Transparency

- Public Blockchains (Ethereum, Solano) are open and community-governed.

- Hashgraph, via Hedera, is a council-model (Google, Boeing, IBM, etc.)—providing stability and less decentralization.

If you’re building a community-driven dApp, Blockchain makes the most sense. If you’re doing corporate blockchain or consortium blockchain, Hashgraph offers more clarity and structure.

6️. Regulatory Compliance & Privacy

Both Hashgraph and Blockchain can meet project needs as private, permissioned networks, but with varying degrees of flexibility.

- Blockchain platforms like Hyperledger, Quorum, or Corda are geared towards regulated industries.

- Hashgraph has KYC plugins for compliance built-in, as well as other native privacy filters.

Hashgraph and permissioned blockchains like Hyperledger Fabric make a lot of sense if your projects require HIPAA, GDPR, or ISO compliance.

7. Cost of Development & Maintenance

- Blockchain (especially public networks) could have more expensive gas fees, especially during times of congestion (e.g., Ethereum).

- Hashgraph offers lower and predictable fees, which is advantageous for both microtransactions and real-time applications.

For example, gas costs for a DeFi protocol might not matter due to yield, but in the case of micro-payment or applications with high volume, the predictable fee structures offered by Hashgraph will save significant operational expenses overall.

Real-World Use Cases of Hashgraph and Blockchain in Enterprise Solutions

The best way to compare Blockchain and Hashgraph is to review how each performs against traditional mainframe systems in real-world enterprise scenarios. Here is an overview of use cases, categorized by industry and application, which DLT (Distributed Ledger Technology) to use, and why.

1. Financial Services & DeFi Platforms

Blockchain Fit:

Public blockchains such as Ethereum, Binance Smart Chain, and Polygon are great building blocks for DeFi protocols including lending, yield farming, decentralized exchanges (DEXs), and stablecoins. They allow composability, or the ability of developers to leverage and integrate on top of existing crypto finance infrastructure.

Example: Compound Finance (built on Ethereum) enables lenders to earn interest by lending an asset.

Aave, Uniswap, and Curve are all DeFi built purely on public blockchains.

Hashgraph Fit:

Ideal for businesses with enterprise financial services that need real-time settlement with low latency of transactions and predictable transaction costs.

Examples Include: Central bank digital currency (CBDC) or tokenized cousins of funds with compliance due diligence needs.

Example: Shinhan Bank in Korea explored using Hashgraph for interbank transfers with instant settlement.

Hedera Hashgraph is to be explored by financial institutions exploring micro-payments and fractional ownership of assets.

2. Data Management in health care

Blockchain Fit:

- Blockchain can efficiently manage persistent records and auditable logs, particularly in sector-specific processes including clinical trials and verification of medical credentials.

- MedicalChain and BurstIQ are examples of platforms that use Blockchain to ensure permanent verification of patient records.

Hashgraph Fit

- Hashgraph enables real-time access to data and patient/provider networks.

- With aBFT security and high throughput, Hashgraph allows secure, permissioned sharing of sensitive medical data.

Example: Hashgraph could enable healthcare consortia to synchronize access to Electronic Health Records (EHRs) in real time with control even on data privacy and patients opting in or out.

3. Supply Chain Transparency & Provenance

Blockchain Fit :

- Blockchain can provide traceability, fight counterfeit products, and create audit trails in real-time.

- Blockchain platforms, such as IBM food Trust and VeChain, can effectively trace from farm to table or manufacturer to consumer.

Example: Walmart is utilizing Hyperledger Fabric to track leafy greens, ensuring quicker recalls and safety compliance.

Hashgraph Fit:

Hashgraph fulfills a need for significant volume and frequency in updates, sensor integrations, and real-time tracking, especially when there are multiple parties needing live awareness.

Example:

Logistics providers can use Hashgraph to connect IoT data across widely-separated stakeholders and instantly reconcile shipment availability.

4. Gaming and Digital Assets

Blockchain Fit:

- The foundation of NFT platforms and play-to-earn games.

- Ethereum (incl. L2s like aribtrum), Flow, and Solana dominate the space.

Example:

Axie Infinity and The Sandbox use Blockchain for tokenizing in-game assets and establishing asset ownership.

Hashgraph Fit:

- Hashgraph is much better suited to any real-time gameplay mechanics (e.g. auctions, rapid microtransactions) due to ultra-low latency and high TPS.

- Can be used for tokenized rewards, fraud-proof leaderboards, ad bidding engines inside games, etc.

Example:

Game studios use Hashgraph’s SDK for low-cost, high-speed reward systems.

Conclusion: Hashgraph vs Blockchain - Which Will Power Your Future?

In the fast-moving world of enterprise blockchain solutions, both Hashgraph and Blockchain have been proven effective but serve different business requirements. Blockchain provides a complete decentralized ecosystem that offers a vast amount of solutions in new technology cases through DeFi, NFTs, and Global Payments with a consistent record of success. It is a good fit for public platforms, open networks, and custom blockchain applications that leverage community and composability due to its maturity and level of adoption.

Hashgraph is focused on completely changing performance and fairness, bringing unmatched transaction speed, power consumption, an energy-efficient system, and enterprise-level security. It was built for mission-critical use cases such as real-time financial systems, high frequency Internet of Things (IoT), and compliant data infrastructures.

Where do we go from here?

There is no straight answer to that question because there are options for Distributed Ledger Technology (DLT). The decision is based on your model of business, compliance level, ability to scale, and overall ecosystem strategy.

We At Blockchaintechnologies we don’t just build – we strategize, architect and scale your entire Web3 journey. So whether you are considering privately built blockchain, a custom DLT protocol, or integrating to Hashgraph for an enterprise use case requiring speed – you can trust our team to deliver solutions that future-proof your businesses

Whether you’re launching a custom DeFi platform, exploring private blockchain development, or evaluating Hashgraph for high-performance use cases—BlockchainTechs.io A Leading Blockchain Development Company for Web3 & Enterprise Projects is your trusted partner.

FAQs

The cost of development is influenced by a number of variables such as the complexity, consensus choice, the smart contract layers, and if you are building on Blockchain or Hashgraph.

- Private blockchain development–starts at approximately $10,000.

- Hashgraph-based platforms–typically $15,000 to $100,000.

- A custom blockchain that has advanced features (DeFi, identity, tokenization) is approximately $30,000 to $250,000+.

At BlockchainTechs.io, we offer modular pricing and flexible models for startups or enterprises! Free Estimation Available. Get Free Estimation

MVPs: 4–6 weeks

Enterprise-grade platforms: 3–6 months ( ALways keep it in weeks 8 to 12 weeks)

Additions of 1–2 weeks for compliance integrations (KYC/AML, GDPR)

We embrace a agile process, executing for quickly and securely while acting on feedback

Considerations for selection:

- Speed and scale for transactions

- Security: (i.e., PoW vs. aBFT)

- Energy efficiency

- Maturity of the developer ecosystem

- Regulatory requirements (i.e., privacy, compliance)

- Integration implications with current systems

Definitely. BlockchainTechs.io follows a full-stack approach that connects all of its offerings in:

- Applications that leverage Hashgraph (via Hedera SDKs)

- Private Blockchain Development (Hyperledger, Corda, Quorum)

- Custom blockchain architecture for tokenization, DeFi, identity, and more

- Together with compliance solutions, smart contract audits, cross-chain integration, and more.

Absolutely! There are hybrid solutions. You can use Blockchain for issuance of tokens and registry of assets, and Hashgraph for quick consensus and logging. There are platforms like Chainlink CCIP and Polkadot XCM that can help bridge DLTs. We at BlockchainTechs.io focus solely on interoperability architecture and design multi-chain strategies.