Developing a Crypto Arbitrage Bot Using Flash Loans: A Comprehensive Guide

May 19,2025

Developing a Crypto Arbitrage Bot Using Flash Loans: A Comprehensive Guide

Flash loans have transformed how crypto arbitrage bots trade, and the numbers prove it. Aave’s daily flash loan value skyrocketed from $11 million to over $130 million in just one month during 2020. Traders rushed to adopt this game-changing technology that lets users borrow large amounts of cryptocurrency without any collateral, as long as they pay back the loan in a single transaction. Our experience shows how crypto arbitrage bots can profit from price gaps between exchanges of all sizes. These smart bots complete trades within seconds and capture quick opportunities effectively. The flash loan arbitrage works smoothly – you borrow funds, buy assets at lower prices on one exchange, and sell them for more on another exchange. All this happens in one transaction. This piece will show you how to build a crypto arbitrage bot that employs flash loans to spot and profit from market inefficiencies.

Understanding Flash Loans and Arbitrage Bots

Flash loans represent a groundbreaking development in DeFi trading. They allow traders to access high-speed, capital-free transactions and execute complex strategies within seconds. These loans let traders execute complex strategies without capital requirements. Let’s head over to the mechanics of these loans and see how they power modern arbitrage bots.

What is a flash loan and how does it work?

Flash loans do not need collateral and users must borrow and repay them within the same blockchain transaction. Traditional loans need collateral, but flash loans tap into the full potential of blockchain transactions—they either complete fully or revert completely.

Smart contracts make the process work through these steps:

- A user borrows tokens from a lending pool

- The user puts borrowed funds to work

- The user must return the loan amount plus a fee (typically 0.09% on platforms like Aave) before the transaction ends

The whole ordeal reverses if repayment fails, as if nothing happened. This breakthrough mechanism opens up powerful applications in trading, liquidations, and collateral swapping.

Flash loans change the game by giving everyone access to substantial capital. Anyone can become a well-capitalized trader able to execute large-scale strategies during a single transaction.

How arbitrage bots use flash loans for profit

Crypto arbitrage bots have changed how traders profit from market inefficiencies. These automated programs spot price differences for the same cryptocurrency on different exchanges and trade to profit from these gaps. These bots become more powerful with flash loans. The process works like this: The bot checks multiple exchanges in real time to find price gaps big enough to cover fees and make profit. The bot takes out a flash loan to borrow needed capital once it spots a chance. The bot then runs an arbitrage sequence with the borrowed funds:

- Buy cryptocurrency where prices are lower

- Sell it where prices are higher

- Pay back the flash loan plus fees

- Keep what’s left as profit

Bitcoin prices might differ between two exchanges. The bot could borrow through a flash loan, buy Bitcoin at the lower price, sell it immediately at the higher price, and keep the difference after loan repayment. Get guide for Cryptocurrency exchange platform development

Want to build your own crypto arbitrage bot?

BlockchainTechnologies helps create custom flash loan arbitrage solutions that help you profit from market inefficiencies.

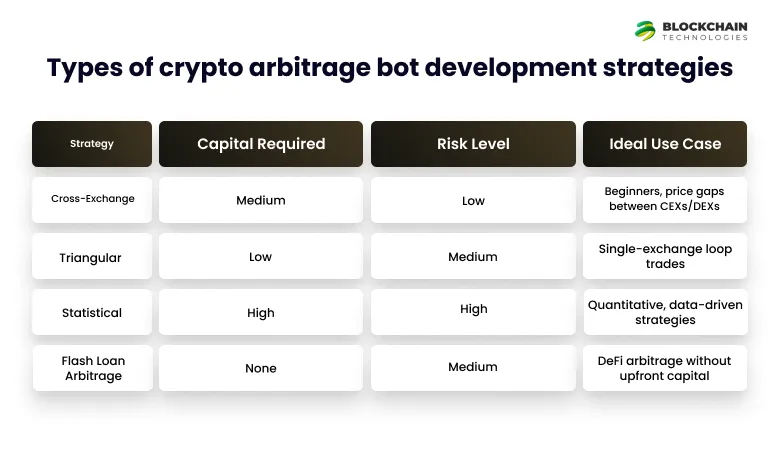

Types of crypto arbitrage bot development strategies

Crypto arbitrage bots can use several different strategies:

- Spatial (Cross-Exchange) Arbitrage: The simplest approach buys cryptocurrency on one exchange at a lower price and sells it on another at a higher price. This strategy uses price differences between platforms caused by varying liquidity and trading volumes.

- Triangular Arbitrage: This strategy trades between three different cryptocurrencies on one exchange. You might convert USDT to BTC, then BTC to ETH, and finally ETH back to USDT—ending up with more USDT than you started with because of inefficient pricing between pairs.

- Statistical Arbitrage: This advanced method uses mathematical models and historical data to predict price movements and find arbitrage opportunities. Algorithms analyze price correlations between different cryptocurrencies.

- Flash Loan Arbitrage: This strategy uses flash loans to execute large arbitrage trades without upfront capital. Borrowing, trading, and repayment happen in one transaction, which reduces risk while maximizing potential returns.

Market volatility, exchange liquidity, and transaction speed determine how well these strategies work. So developers must add risk management features and optimize for gas fees, slippage, and latency to make their crypto arbitrage bots profitable.

Fundamentals for Building a Crypto Arbitrage Bot

You need specific skills, tools, and knowledge to build a successful crypto arbitrage bot that uses flash loans. Let’s look at what you need to create an effective system. You need specific skills, tools, and knowledge to build a successful crypto arbitrage bot that uses flash loans. Let’s look at what you need to create an effective system.

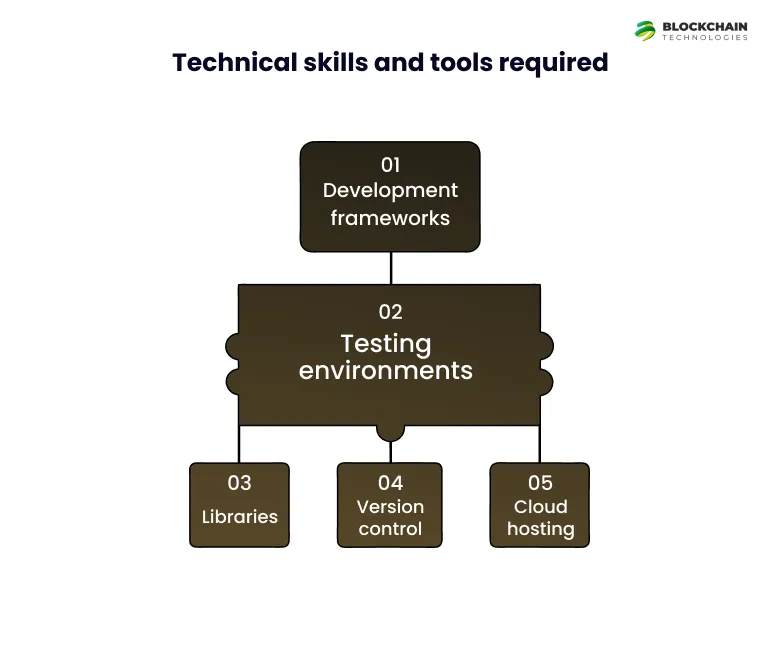

1. Technical skills and tools required

A crypto arbitrage bot needs both programming expertise and financial knowledge. You should master at least one programming language. Python is a great choice because it’s simple and has many data analysis libraries like Pandas and NumPy. JavaScript (with Node.js) works well for handling multiple exchanges at once. C++ and Java give you better performance when you trade at high frequencies. You must know Solidity to work with flash loans since most Ethereum smart contracts use this language. Smart contracts are the foundation of flash loan features, so this skill is a must-have. Your development toolkit should include:

- Development frameworks: Truffle, Hardhat, or Brownie to create and test smart contracts

- Libraries: CCXT to integrate exchange APIs, Web3.js or Ethers.js to interact with blockchain

- Testing environments: Local blockchain setups like Ganache to test without risks

- Version control: Git to track code changes and work together

- Cloud hosting: AWS or DigitalOcean to run your bot all day

Quick transaction execution needs reliable blockchain nodes. You can run your own or use providers to minimize delays.

2.Using DeFi Protocols for Crypto Arbitrage

DeFi protocols like Aave, dYdX, and Uniswap form the foundation of flash loan arbitrage. These platforms offer the infrastructure needed for instant borrowing, liquidity access, and trade execution—enabling bots to profit without upfront capital. Integrating multiple protocols helps diversify opportunities and reduce dependency on a single network.

3. Choosing the right blockchain and DeFi protocols

The right blockchain network matters a lot for your crypto flash loan arbitrage bot. Ethereum leads the way for flash loans because it started this concept through protocols like Aave. The high gas fees on the Ethereum mainnet can reduce your profits. Polygon (formerly Matic Network) offers a great alternative. It works with Ethereum-based smart contracts but has much lower fees. This makes it perfect to test and run your arbitrage strategies.

You have several options for flash loan providers:

- Aave: The pioneer of flash loans with various assets to borrow

- dYdX: One platform for margin trading, lending, and flash loans

- Uniswap: Offers “flash swaps” for arbitrage

- SushiSwap: Works like Uniswap but with more flexibility

- Balancer: Custom liquidity pools you can optimize with flash loans

Build Your Own Arbitrage Bot – Get the Step-by-Step Blueprint!

Want to build your own arbitrage bot? Grab our step-by-step Arbitrage Bot Blueprint now!

4. Understanding smart contracts and gas fees

Smart contracts run automatically on the blockchain. They handle borrowing, trading, and repayment processes. Your flash loan arbitrage contracts should:

- Borrow funds from lending protocols

- Execute trades across different exchanges

- Return the borrowed amount plus fees in one transaction

Security comes first in smart contracts. Bad code can cost you money. In fact, 75% of failed flash loan transactions happen because of smart contract errors, not market conditions.

Gas costs matter with flash loans because these complex transactions do many things. To make more profit:

- Cut down on storage operations that use the most gas

- Use smaller data types when you can (uint8 instead of uint256)

- Group transactions to lower overall costs

- Watch gas prices on EthGasStation to time your transactions better

Large trades can change market prices, causing slippage issues. Your smart contracts need good slippage control to stay profitable. Building a crypto arbitrage trading bot with flash loans takes work but can pay off well. BlockchainTechnologies has helped many clients overcome these technical challenges to build profitable arbitrage solutions.

How to Build a Crypto Arbitrage Bot Using Flash Loans- Step-by-step guide

Let’s break down step-by-step guide to building a flash loan arbitrage bot now that you know the basics. A working crypto flash loan arbitrage bot needs precise coding, careful planning, and extensive testing to make money in these fast-moving cryptocurrency markets.

Step 1: Define your arbitrage logic

The success of any crypto arbitrage bot depends on a solid trading strategy. “Onchain searching” stands out as the quickest way to handle flash loan arbitrage. This method calculates trade amounts right on the blockchain during transactions. Your bot will:

- Spot price differences between cryptocurrency exchanges immediately

- Work out the best trade amounts based on market conditions

- Run transactions only when profits are guaranteed

Your bot watches transactions for specific tokens and calculates profits before execution. This smart approach means no unprofitable trades hit the chain, which saves you money on gas fees.

Want proof it works?

See how our custom bot delivered a 23% monthly ROI in live DeFi markets.

Step 2: Write and test the smart contract

Smart contracts are the foundations of your flash loan arbitrage bot. You’ll need two key parts: Start with a core logic contract that handles arbitrage between exchanges (usually Uniswap-V2-style platforms). This contract should check token balances before and after trades to verify profits. Next, build a capital-management contract to:

- Get funds through flash loans

- Make trades on different exchanges

- Pay back the loan and fees in one transaction

- Send profits to specified wallets

Want to skip the complex coding?

Our experts at BlockchainTechnologies will build a custom crypto arbitrage bot that matches your strategy.

Step 3: Integrate with DEXs and flash loan providers

The next step links your smart contract to decentralized exchanges and flash loan providers. Most flash loan arbitrage bots connect with:

- Flash Loan Providers: Aave, dYdX, or Balancer

- DEXs: Uniswap, SushiSwap, or other Uniswap V2 forks

To cite an instance, with Aave integration, your bot calls the flashLoan() function, runs arbitrage logic through receiveTokens(), and confirms loan repayment before finishing the transaction.

Step 4: Deploy and monitor your bot

Test everything on Sepolia first – it costs less in gas than Goerli. Then move to the mainnet. A reliable monitoring system will help you succeed:

- Track performance in real time to check profitability

- Set up alerts for market changes

- Build a dashboard to see bot operations and trades

- Keep improving gas usage and slippage settings

Gas optimization helps maximize your profits. Launch your contract when network traffic is low and use efficient code to cut computational costs. Your crypto arbitrage trading bot can tap into the full potential of DeFi markets and generate substantial returns through flash loan arbitrage with constant improvements and market analysis.

Risks and Rewards of Flash Loan Trading Bots

Rewards:

- High potential returns with zero upfront capital

- Exploiting short-lived price inefficiencies across DeFi

- Full automation with minimal human intervention

Risks:

- High gas fees may outweigh potential profits

- Price slippage and front-running risks

- Smart contract vulnerabilities

- Legal and regulatory uncertainty in some jurisdictions

To maximize rewards and reduce risk, developers must combine technical rigor with continuous performance monitoring.

Optimizing Performance and Reducing Risks

You’ve built and deployed your crypto arbitrage bot. Now comes a vital phase – making it better and safer. The time difference between profit and loss is just milliseconds, and fees matter a lot. Let’s learn how to make your bot work better and keep it secure.

1. Gas optimization and slippage control

Gas optimization helps you stay profitable in flash loan arbitrage. High transaction costs can eat into your profits, especially on networks like Ethereum. You can make your smart contract code better by:

- Keeping storage operations low as they use the most gas

- Using smaller data types when you can (uint8 instead of uint256)

- Cutting down extra computations and loops

Putting transactions together in one operation cuts down gas costs by a lot. Web3.js helps you estimate gas before sending a transaction to set good limits and avoid paying too much.

Slippage is the gap between what you expect to pay and what you actually pay. You can control it better by:

- Setting how much slippage your bot can handle

- Trading on exchanges with high liquidity to keep prices stable

- Using limit orders instead of market orders when you can

Example: A 1% slippage on a $50,000 arbitrage trade can wipe out $500 of your profit. Tight slippage settings help avoid this kind of unexpected loss.

Need help optimizing your trading strategy?

BlockchainTechnologies offers customized crypto arbitrage bot development solutions with advanced gas optimization algorithms.

2. Latency reduction and server setup

Every millisecond matters in latency arbitrage.Using a virtual private server(VPS) makes your bot work better by running 24/7, with its own resources and fast connection. Your latency goes down when you:

- Put servers close to exchange data centers

- Use fiber-optic connections to move data faster

- Get direct market access where you can

- Keep network equipment running well

Your server setup affects how fast trades happen. High-frequency trading needs strong computers that can process deals super fast. VPS environments also give better protection against unwanted access.

3. Security audits and fail-safe mechanisms

Security is top priority when you build a crypto flash loan arbitrage bot. One weak spot could cost you big money. Here’s how to stay secure:

- Check smart contracts thoroughly with tools like MythX or ConsenSys Diligence

- Add reentrancy guards to stop attacks

- Put in circuit breakers to stop contracts when things look wrong

- Keep API keys encrypted and limit who can withdraw funds

You need “fail-safe” systems that spot threats and fight back right away. BlockchainTechnologies knows how to build crypto arbitrage bots with strong security that fits your trading style. We help you make more money while keeping your investments safe. Building a profitable crypto arbitrage bot comes with complex technical challenges. These can overwhelm even seasoned developers. But teaming up with experts can speed up development and boost your odds of success.

Get Expert Help from BlockchainTechnologies

Blockchain technologies - The Best Crypto Arbitrage Trading Bot Development Company

Blockchain Technologies builds advanced flash loan arbitrage bots that maximize profits across DeFi platforms. Our team knows the ins and outs of flash loans and arbitrage strategies to keep your bot running at peak efficiency. Our dev team delivers:

- Custom crypto trading Bot Development – We blend key technologies to create your trading bot that matches your needs and risk comfort level

- Immediate Monitoring – Smart dashboards track key metrics and adjust to market shifts

- Security First – Our reliable smart contracts include error-handling to safeguard your investments

- Always-On Support – We keep optimizing and helping after launch to maintain your edge

Want to start making profits?

Talk to our blockchain experts about your crypto arbitrage project today!

Conclusion

Flash loan arbitrage bots are at the cutting edge of cryptocurrency trading. They combine smart programming with financial strategy. This piece explored flash loans, arbitrage strategies, and technical frameworks you’ll need for success. Building these systems takes expertise in many areas – from Solidity programming to exchange API integration.

The potential returns make this attempt worth your time and resources. Gas fees, slippage, and security issues are the most important challenges that you must monitor and optimize. Your server infrastructure choices affect execution speed and profits.

Traders who lack development experience can team up with specialized developers to enter the market faster. Our team at BlockchainTechnologies helps you skip the technical hurdles and launch your arbitrage strategy quickly.

FAQs

Flash loan arbitrage involves borrowing funds, executing trades across different exchanges to profit from price differences, and repaying the loan within a single transaction. The bot identifies opportunities, borrows the necessary capital, buys low on one exchange, sells high on another, repays the loan with interest, and keeps the profit.

Crypto arbitrage bots can still be profitable, but their success depends on various factors such as market conditions, bot performance, and strategy implementation. These bots have the advantage of monitoring multiple markets simultaneously, potentially capturing fleeting opportunities that manual trading might miss.

Creating a crypto arbitrage bot involves defining your arbitrage logic, writing and testing smart contracts, integrating with decentralized exchanges and flash loan providers, and deploying and monitoring the bot. It’s crucial to optimize for gas fees, implement security measures, and continuously refine the strategy based on performance data

If a flash loan isn’t repaid within the same transaction, the entire transaction is automatically reversed by the smart contract. This means all operations executed using the borrowed funds are undone, and it’s as if the transaction never occurred. This mechanism ensures the lender’s funds are protected.

To optimize a crypto arbitrage bot, focus on gas optimization and slippage control, reduce latency through strategic server setups, and implement robust security measures. This includes minimizing computational costs, setting appropriate slippage tolerances, using high-speed connections, and conducting regular security audits to protect against vulnerabilities.