AI in Crypto Trading: Predictive Analysis & Real-Time Market Forecasting Tools

May 29,2025

The cryptocurrency market, infamous for its high volatility and nonlinear price behaviors, has witnessed a remarkable evolution with the integration of Artificial Intelligence (AI).

- According to Fortune Business Insights, the broader artificial intelligence market is projected to increase from USD 294.16 billion in 2025 to USD 1,771.62 billion by 2032, exhibiting a CAGR of 29.2% during the forecast period.

- This exponential growth highlights the critical role of AI in crypto trading, enabling more precise forecasting, improved risk assessment, and enhanced portfolio optimization strategies at scale.

- Moreover, findings from a recent PMC publication highlight that AI-driven investment forecasting decreases prediction error margins by up to 35% compared to traditional statistical models like ARIMA or GARCH.

The use of AI eliminates emotional bias in trade decisions, improves scalability through algorithmic adaptability, allowing systems to auto-calibrate in response to evolving market dynamics.

This blog post will delve into the crucial role of AI in optimizing crypto markets through predictive analytics in cryptocurrency, exploring how machine learning in crypto trading is used for crypto market forecasting with AI and enhancing investment strategies.

What is Predictive Analysis in Cryptocurrency?

In this crypto world, how AI Helps in Predictive Analysis for Cryptocurrency Price Movements is a very discussion topic. A data-driven approach that leverages AI crypto analysis, machine learning in crypto trading, and real-time crypto data analysis to forecast future price movements and market trends with greater accuracy.

Understanding Predictive Analytics in Crypto

Predictive analytics uses statistical models, algorithms, and historical data to predict future outcomes. In the context of crypto market forecasting with AI, this involves analyzing:

- Historical price trends

- Market sentiment

- Trading volume

- Blockchain data

- News and social media signals

This enables users to find the answers for how accurate is AI in crypto trading? This enables to generate crypto signals, anticipate volatility, and even detect upcoming trends before they go mainstream

How Machine Learning Powers Crypto Forecasting

Machine learning in crypto trading has become the powerhouse behind smarter, faster, and more accurate decisions. With the immense volume of data generated by the blockchain ecosystem, it’s no longer possible to rely solely on human intuition. Instead, AI crypto analysis powered by machine learning models helps uncover hidden patterns, market trends, and trading opportunities in real-time.

Whether you’re a seasoned investor or just entering the market, understanding how machine learning in the crypto market works can give you a strategic advantage.

What Is Machine Learning in Crypto Trading?

- Predict short- and long-term cryptocurrency price movements

- Detect anomalies or manipulation

- Optimize buy/sell strategies automatically

- Deliver highly accurate crypto signals

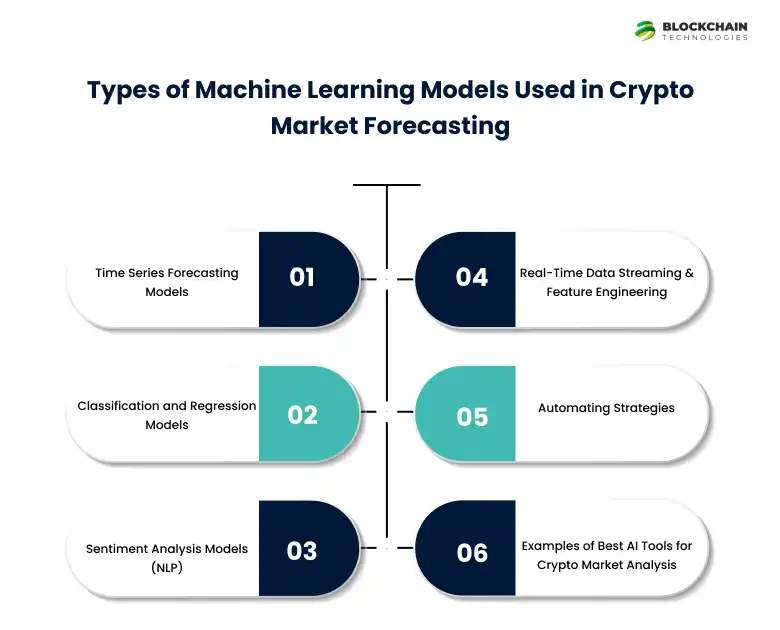

Types of Machine Learning Models Used in Crypto Market Forecasting

Different ML models serve different purposes. Here are the most commonly used ones in crypto market forecasting with AI:

1. Time Series Forecasting Models

These models analyze past pricing data to predict future market trends. Common techniques include:

- ARIMA (AutoRegressive Integrated Moving Average) – Forecasts based on trends and seasonality.

- LSTM (Long Short-Term Memory) – A type of Recurrent Neural Network (RNN) that captures long-term dependencies in data, making it ideal for predicting volatile crypto prices.

Use Case: How AI helps in crypto price prediction becomes tangible through LSTM networks that detect bullish or bearish momentum based on past behavior.

2. Classification and Regression Models

Used to classify market movement or predict specific price values:

- Logistic Regression, Decision Trees, and Support Vector Machines (SVM) are often applied for direction prediction.

- Regression models help predict exact price points for assets like Bitcoin or Ethereum. These models are key to AI for cryptocurrency investment analysis, helping investors understand whether to hold, buy, or sell.

3. Sentiment Analysis Models (NLP)

Natural Language Processing (NLP) models extract emotion, tone, and opinions from textual sources like Reddit, Twitter, and Telegram.

- Sentiment data is turned into trading signals.

- NLP is especially useful in AI-driven sentiment analysis in crypto markets where news and social media sentiment influence volatility.

Example: A sudden surge in negative tweets about a coin can trigger sell signals based on sentiment scores.

Real-Time Data Streaming & Feature Engineering

Modern AI systems thrive on real-time crypto data analysis, where streaming data is continuously fed into the models for instant decision-making. To ensure accuracy, feature engineering plays a crucial role in creating meaningful data inputs such as:

- Price fluctuation rates

- Volume-weighted average prices (VWAP)

- On-chain metrics (e.g., hash rate, active wallets)

This refined data powers AI finance tools for better crypto portfolio optimization with AI.

Automating Strategies

Another advanced use case is reinforcement learning, where algorithms learn optimal trading strategies by receiving rewards for correct predictions.

- These AI agents simulate thousands of market scenarios.

- Learn from success/failure and refine their trading tactics.

This technique is highly relevant in using machine learning for crypto trading strategies, especially for bots and automated trading platforms.

Examples of Best AI Tools for Crypto Market Analysis

So, What is the best AI tool for crypto signals? These platforms show the practical implementation of AI crypto market analysis across different user levels.

- Numerai – Crowdsources models from data scientists to predict market movement.

- CryptoHopper – Uses AI to automate trades based on multiple technical indicators.

- TradeSanta – Combines bots with machine learning for better entries/exits.

- IntoTheBlock – Offers AI-powered market insights using on-chain data and sentiment analysis.

Ready to Predict the Next Market Move?

Leverage AI-powered forecasting and make smarter crypto decisions in real time!

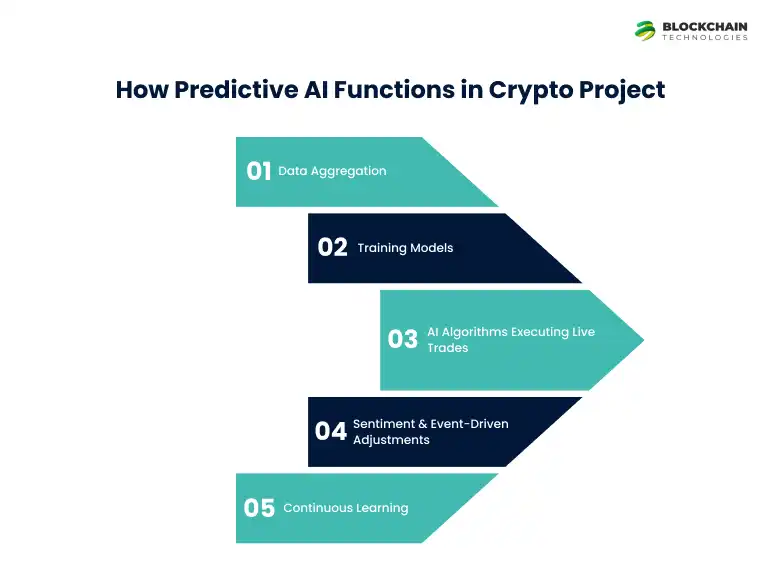

How Predictive AI Functions in Crypto Project

Predictive analytics in cryptocurrency has revolutionized how crypto projects function from identifying patterns to executing trades. By leveraging AI crypto analysis, investors gain real-time insights, automate strategies, and forecast price trends with minimal emotional bias. Let’s dive into how this transformative process works inside real-world crypto ecosystems.

Data Aggregation

Before predictions come to life, AI models need a massive pool of clean, diverse, and accurate data. That’s why modern crypto projects rely heavily on real-time crypto data analysis. These datasets include exchange metrics, social sentiment, on-chain data, and news sentiment, all of which feed into the intelligence engine. This process lays the groundwork for smarter AI crypto market analysis.

- Collects high-frequency crypto data from exchanges, wallets, and blockchains.

- Incorporates external sources like social media and crypto forums for behavioral trends.

- NLP and data cleaning tools filter irrelevant or noisy inputs.

- Fuels predictive engines for consistent crypto signals generation.

Training Models

Once the data is in place, Implementing predictive analytics in cryptocurrency trading enables the next step: pattern recognition and price forecasting. These models study past and present market conditions to predict future movements. This is how AI helps in crypto price prediction, detecting price breakouts, reversals, or consolidations before they happen. Algorithms learn continuously and adapt to volatility.

- Uses deep learning models like LSTM and Transformers for time-series forecasting.

- Learns technical indicators such as RSI, MACD, and moving averages.

- Applies AI for cryptocurrency investment analysis to forecast asset performance.

- Continuously retrains using updated market data for higher accuracy.

AI Algorithms Executing Live Trades

Predictive models are integrated into trading platforms to automate decision-making in real time. These smart agents analyze market shifts and respond instantly, executing trades with precision. This is key in AI in crypto trading, where speed, timing, and accuracy drive profitability.

- Integrates directly with exchanges to enable AI trading automation.

- Executes strategies based on pre-set confidence levels and risk tolerance.

- Supports both rule-based and dynamic ML decision logic.

- Enhances crypto portfolio optimization with AI for long-term growth.

Sentiment & Event-Driven Adjustments

Crypto is about crowd sentiment and reaction to news. AI enhances forecasting accuracy by analyzing emotional data using AI-driven sentiment analysis in crypto markets. This ensures that crypto projects remain sensitive to hype cycles, market fear, or sudden token buzz. It’s especially effective for short-term moves or post-announcement volatility.

- NLP models evaluate social media and news sentiment in real time.

- Adjusts crypto trading strategies based on rising or falling confidence scores.

- Highlights market-moving keywords and emotional tone shifts.

- Boosts responsiveness in high-FUD or high-FOMO environments.

Continuous Learning

The final puzzle piece is self-improvement. Predictive AI in crypto thrives on evolution. With feedback loops and retraining, models stay sharp and aligned with the market’s pulse. This process ensures sustainable accuracy for crypto market forecasting with AI, even as trends, tools, and tokens shift rapidly.

- Models retrain daily or weekly with fresh data streams.

- Detects drift in user behavior, token utility, or investor trends.

- Maintains model health to avoid prediction fatigue or overfitting.

- Powers long-term machine learning in crypto market performance.

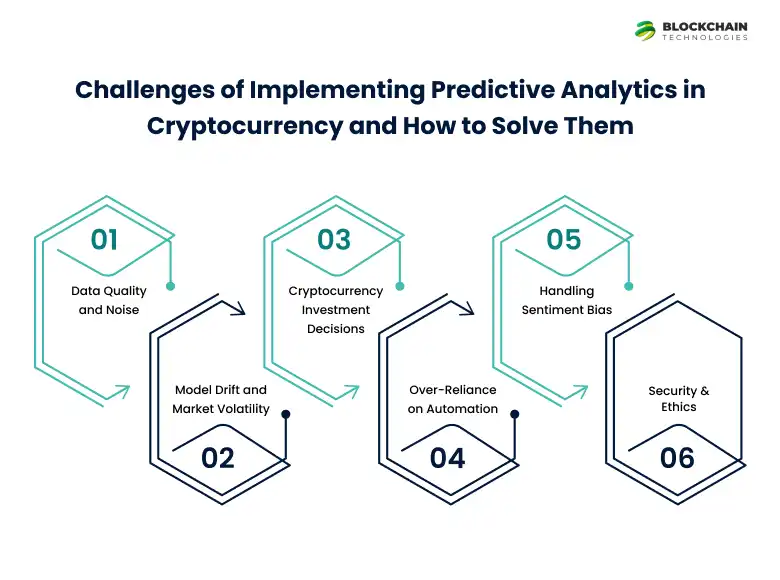

Challenges of Implementing Predictive Analytics in Cryptocurrency and How to Solve Them

As predictive analytics in cryptocurrency continues to redefine market forecasting and trading strategies, it brings not only opportunities but also a set of technical, operational, and ethical challenges. But with the right tools and approaches, these hurdles can be transformed into stepping stones toward innovation.

Data Quality and Noise

The decentralized and fragmented nature of the crypto ecosystem means that real-time crypto data analysis often suffers from inconsistencies, duplication, and incomplete datasets. This challenge makes it difficult to train reliable AI models that depend on clean, structured data.

Solution:

- Use advanced ETL (Extract, Transform, Load) pipelines to preprocess and sanitize incoming data streams.

- Integrate anomaly detection systems to flag outliers in AI crypto market analysis.

- Employ data fusion techniques to combine multiple sources and validate crypto signals more effectively.

Model Drift and Market Volatility

Due to the high volatility of cryptocurrencies, AI models trained even a month ago can become obsolete quickly. This leads to model drift, where predictions based on outdated training no longer reflect the current market.

Solution:

- Implement continuous learning frameworks and retrain models using machine learning in crypto trading.

- Leverage adaptive algorithms that can recalibrate based on new patterns and outliers.

- Use ensemble models to balance short-term and long-term forecasts in AI crypto analysis.

Cryptocurrency Investment Decisions

Many traders struggle to understand the rationale behind AI-generated predictions, which creates skepticism and hesitancy in trusting AI for cryptocurrency investment analysis.

Solution:

- Use explainable AI (XAI) methods like SHAP and LIME to break down prediction logic.

- Visualize price projections and confidence levels in dashboards for transparency.

- Train teams on how AI helps in crypto price prediction using model interpretation tools.

Over-Reliance on Automation

Fully automating trades with AI in crypto trading can be risky if models act on incorrect signals or fail to account for sudden news events or regulatory changes.

Solution:

- Combine automated trading with human-in-the-loop oversight to ensure safety.

- Add rule-based fail-safes to stop trades if anomaly thresholds are breached.

- Monitor performance in real time with A/B testing to validate crypto trading strategies powered by AI.

Handling Sentiment Bias

AI models that include AI-driven sentiment analysis in crypto markets often face challenges with fake news, bot-generated hype, or language ambiguity.

Solution:

- Use advanced NLP models trained on crypto-specific lexicons.

- Filter out low-quality or manipulated sources using credibility scoring algorithms.

- Combine sentiment with technical indicators to make crypto portfolio optimization with AI more robust.

Security & Ethics

Privacy concerns, data leaks, and biased decision-making can occur when handling sensitive user and market data with predictive AI systems.

Solution:

- Apply secure multi-party computation (SMPC) or federated learning where needed.

- Perform regular audits of AI pipelines for fairness, accountability, and transparency.

- Educate stakeholders on the ethical use of AI finance tools in crypto ecosystems.

Real-Time Market Forecasting Tools:

In the fast-paced world of cryptocurrency, where volatility is the norm, real-time market forecasting tools powered by AI are game-changers. These tools leverage cutting-edge technologies to deliver instant, data-backed predictions, helping traders and investors make informed decisions within seconds.

The Tech Behind Real-Time Forecasting

AI-based forecasting tools combine multiple components to ensure accurate, dynamic market predictions:

1. Live Data Ingestion Engines

These tools continuously gather and process data from multiple sources including:

Efficient handling of real-time market data and bot actions requires high-performance databases. Tools like PostgreSQL and TimeScaleDB are ideal for storing large-scale, time-series trading datasets with precision and speed.

- Exchange APIs (e.g., Binance, Coinbase)

- Blockchain analytics

- News feeds and social media sentiment

- On-chain activity and wallet movements

Real-time data streaming is enabled using platforms like Apache Kafka and Flume, ensuring zero lag.

2. Predictive Machine Learning Models

Once data is ingested, AI models trained on historical and real-time data kick in:

- Time-Series Models: LSTM (Long Short-Term Memory), ARIMA, Prophet

- Reinforcement Learning: For adapting strategies based on market conditions

- Ensemble Models: Blend multiple algorithms to reduce prediction error

These models consider factors like momentum, volume spikes, RSI levels, and market sentiment to generate real-time forecasts.

3. Sentiment Analysis with NLP

AI tools also apply Natural Language Processing (NLP) to decode sentiment from:

- Twitter and Reddit threads

- Telegram and Discord communities

- Global news headlines

NLP models like BERT or RoBERTa analyze language tone, frequency of keywords, and emerging discussions to capture shifts in market mood, often before prices move.

4. Dynamic Dashboards and Alerts

The final output is visualized through:

- Real-time dashboards with trading signals

- Volatility heatmaps

- Price prediction curves

Smart alerts via email, SMS, or in-app push notifications

Dominate the Crypto Market with Real-Time Insights!

Your edge is just one smart tool away from market mastery.

Real-Life Use Cases of Predictive AI in Crypto

1. Binance

Binance, one of the largest cryptocurrency exchanges globally, uses advanced AI in crypto trading to power its predictive algorithms. Their systems analyze real-time crypto data, track market volatility, and generate crypto signals that help traders spot price swings before they happen.

By leveraging machine learning in crypto market predictions, Binance uses a combination of technical indicators (MACD, RSI, Bollinger Bands) and AI-driven sentiment analysis in crypto markets to forecast potential price movements. This is especially useful for high-frequency trading bots and advanced retail investors looking to automate their trades intelligently.

2. Numerai

Numerai is a hedge fund built on a crowdsourced AI model. Thousands of data scientists from around the world contribute models that are trained on anonymized financial data, including crypto market forecasting with AI.

Numerai incentivizes participation through its native cryptocurrency (Numeraire), and uses predictive analytics in cryptocurrency to create an ensemble model that drives their investment strategies. Their platform exemplifies how decentralized data science can be applied to AI crypto market analysis while maintaining privacy using cryptographic techniques like secure multi-party computation (SMPC).

3. CryptoHopper

CryptoHopper is a popular AI trading platform that allows users to build, backtest, and deploy custom crypto trading strategies powered by AI. Their platform specializes in crypto portfolio optimization with AI, helping users diversify assets, balance risk, and improve long-term ROI.

CryptoHopper uses AI finance tools such as trailing stop-loss algorithms, adaptive trend recognition, and machine learning-based pattern recognition to automate trades. Their bots can scan hundreds of markets 24/7 and adapt strategies based on how AI predicts cryptocurrency price movements.

Future of Predictive Analytics in Cryptocurrency

As AI crypto analysis and machine learning in crypto trading evolve, the future looks promising for smarter, faster, and more secure crypto decision-making. Here’s what lies ahead:

- Autonomous AI Crypto Trading Bots AI bots will increasingly execute trades based on real-time crypto data analysis and evolving predictive models, making human intervention optional.

- AI-Driven Sentiment Analysis Advancements in AI-driven sentiment analysis in crypto markets will offer real-time insights from millions of social and news signals, improving price forecasting.

- Smarter Crypto Portfolio Optimization AI will fine-tune asset allocations using adaptive algorithms for crypto portfolio optimization with AI, maximizing gains while managing volatility.

- Mainstream Adoption of Predictive AI With better transparency and trust, more institutions will adopt predictive analytics in cryptocurrency to fuel long-term strategies and reduce manual effort.

- Integration with Blockchain The future will see AI finance tools working on-chain, bringing transparency and auditability to AI crypto market analysis models.

Final thoughts:

The integration of AI crypto analysis, machine learning in crypto trading, and predictive analytics in cryptocurrency is revolutionizing how traders and investors understand and respond to the volatile crypto market. From crypto portfolio optimization with AI to real-time crypto data analysis, AI offers a competitive edge by enhancing accuracy, automating strategies, and minimizing risk. To stay ahead, partnering with a reliable blockchain development company becomes essential, one that understands both the data science and the decentralized foundation of crypto.

For businesses looking to build secure, scalable, and AI-powered decentralized solutions, working with a proven blockchain app development company like Blockchain Technologies is the key. With deep expertise in predictive modeling, smart contract integration, and blockchain-based automation, Blockchain Technologies delivers intelligent, future-ready crypto platforms tailored to the needs of modern investors and enterprises.

Ready to revolutionize your crypto trading strategy?

Leverage the best AI tools for crypto market analysis and stay ahead with real-time predictive insights.

FAQs:

AI analyzes historical price trends, real-time market data, and social sentiment to forecast crypto price movements more accurately than traditional models.

Yes, AI-powered tools use machine learning to detect patterns, optimize buy/sell timing, and generate crypto signals, making trading more data-driven and less emotional.

Development costs range from $40,000 to $300,000+, depending on features, AI complexity, and security requirements.

Absolutely! Tools like CryptoHopper and TradeSanta offer user-friendly AI trading bots and insights even for newcomers in the crypto space.

AI uses Natural Language Processing (NLP) to scan social media, news, and forums to gauge investor sentiment, helping predict market trends based on crowd emotions.