DeFi Application Development That Powers the Future of Finance

From decentralized exchanges (DEXs) to staking, lending, and yield farming platforms, we build secure, scalable, and high-performance DeFi applications.

Decentralized Finance Application Development (DeFi)

We help enterprises and evolving startups to replace conventional financial system with decentralized finance platforms. The main scope of DeFi is delivering equitable monetary services to vast population of the world. This blockchain-based DeFi system gives access to major functions such as lending or borrowing loans, trading, tokenization and lot more. Moreover, DeFi application provides more security, cuts down transaction fees, provides high transparency and can even attribute in the absence of an intermediary.

Along with the aforementioned functionalities, some of the main features are transparency, P2P transactions, data integrity, distributed ledger, consensus protocols and immutable. We are the leading DeFi Development Service provider with hands-on experience in building a successful Defi application roadmap for your business. Our team of experts will help you to replace the next-gen industrial revolution of Decentralized Finance Development with expertise skill.

Future Proof Your Business With DeFi App Development Services

DeFi Exchange

Apps

Build secure and automated decentralized exchange (DEX) apps for seamless crypto trading on mobile and web.

DeFi Crypto Banking

Apps

Mobile and web apps that let users access crypto financial services with an intuitive interface.

DeFi P2P Lending

Apps

Apps for instant loans, flexible interest rates, and borderless peer-to-peer lending.

DeFi Staking

Apps

Platforms that reward users based on asset value, timeframe, and consensus protocols.

DeFi Wallet App Development

User-friendly wallets offering full control, private keys, and hardware-backed security.

DeFi Yield Farming

Apps

Apps to lock cryptocurrencies in pools and earn rewards through yield farming strategies.

From Idea to Impact: DeFi App Case Studies

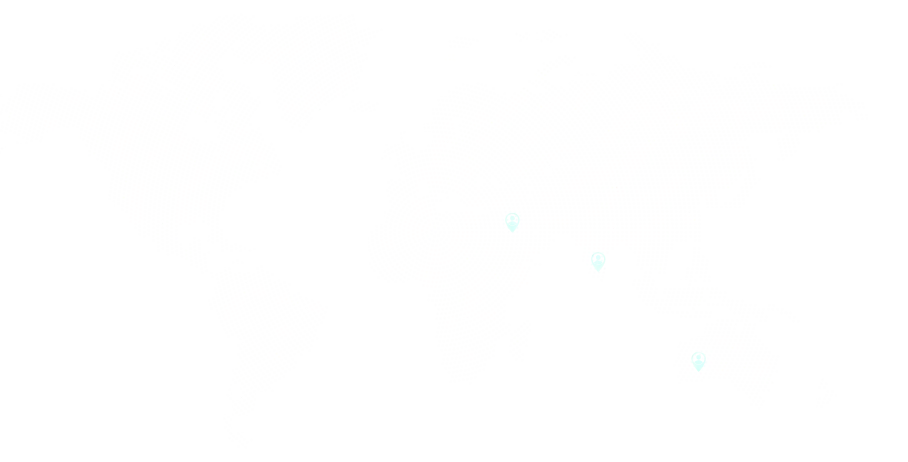

BT Swap

Decentralized Crypto Exchange

BT Swap is a hybrid multichain decentralized exchange (DEX) with BT Swap design. It is based on the Uniswap constant-product automated market maker (AMM). In an AMM, liquidity providers simply deposit pairs of tokens and an algorithm automatically makes markets for the token pair.

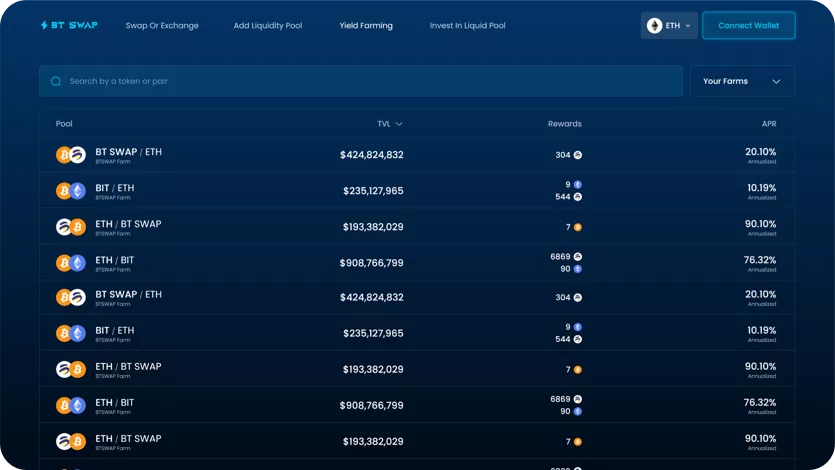

Hive Investments

NFT Auction Platform

NFT auction platform to raise capital. Top 20 premium NFTs are offered for auction for community to bid to invest on the project. smart contract wth timed auction logic for transparancy.

Metaplexar

DeFi DAO Protocol

Decentralized finance protocol to make crypto investments more simple and secure. Multiple investment pools with dedicated smart contract and consensus to manage independently to mitigate single point of failure.

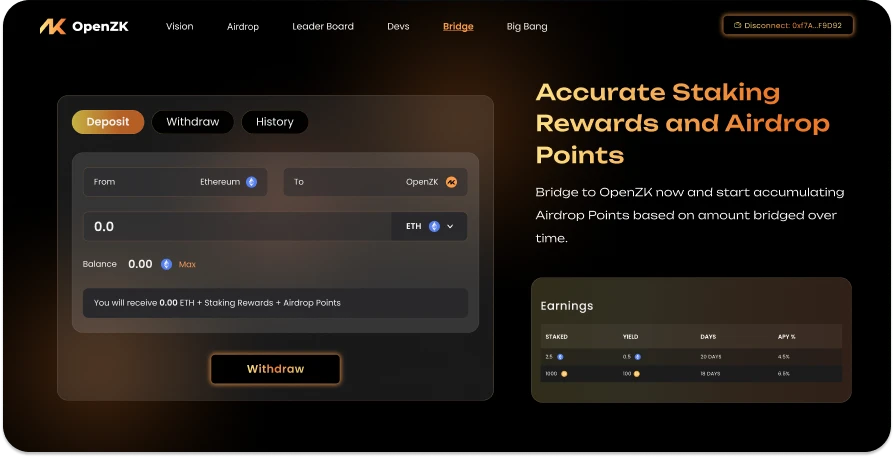

Open ZK

ZK Rollup Layer - 2 Chain

Open ZK rollups solutions utilizing zero-knowledge proofs to enable platform to scale without compromising decentralization. Open ZK Rollups ensures faster transactions and reduced fees while maintaining the integrity of the main chain.

The Rise of DeFi: Key Stats You Can’t Ignore

Decentralized Finance (DeFi) is experiencing unprecedented growth in 2026, solidifying its position as a cornerstone of the global financial ecosystem.

DeFi protocols have surpassed $237 billion in TVL as of Q3 2025, marking a significant milestone in the industry's expansion.

The DeFi user base is projected to reach 213 million by the end of 2026, reflecting a 2.71% global penetration rate.

The global DeFi market is valued at $47.36 billion in 2026, with expectations to grow to $2.02 trillion by 2035, driven by a 51.2% CAGR.

Traditional financial institutions are increasingly adopting DeFi solutions, enhancing credibility and liquidity.

The tokenization of real-world assets is gaining traction, bridging the gap between traditional and decentralized finance.

Ongoing efforts to establish clear regulatory frameworks are fostering a more secure and compliant DeFi environment.

Build Faster. Launch Smarter. Dominate DeFi.

We craft DeFi apps that are secure, scalable, and ready to lead. Partner with Blockchaintechs.io — where innovation meets execution.

Benefits of DeFi Application Development Services

User Access And Control

Users have complete control over their private keys in a DeFi architecture. They can manage assets individually and from any location using their crypto wallets, interacting directly with the decentralized network.Immutability

Transactions in DeFi are tamper-proof and stored immutably on the blockchain. They can be validated by any user, enhancing security and auditability.Interoperability

DeFi tools and applications connect seamlessly thanks to shared standards — like building blocks, they can be combined to create entirely new financial products.Programmable Assets

DeFi apps use Smart Contracts to automate the creation and management of financial instruments and digital assets, ensuring peer-to-peer transactions without middlemen.No Downtime

Smart Contracts in Dapps function continuously once deployed. They don’t require maintenance downtime and cannot refuse service arbitrarily.Complete Information Integrity

Data stored using cryptographic algorithms is permanent and indisputable. All exchange information is transparent and verifiable, preventing forgery.Disseminated Applications

Decentralized apps (Dapps) are highly resilient and hard to shut down, unlike centralized systems. As long as the underlying blockchain operates, Dapps remain functional.All Dapps are Decentralized

Unlike traditional apps, all Dapps store data on public, decentralized ledgers, ensuring transparency and resistance to centralized control.Open-source

Dapps are typically free and open-source. Their codebase is publicly available for inspection and improvement, encouraging community governance and transparency.Traditional Finance vs. DeFi: The Ultimate Smackdown

Why settle for slow when you can go trustless?

Traditional Finance

Intermediaries

Banks, brokers, and paperwork.

Speed

3-5 days for cross-border payments.

Fees

Hidden charges, middlemen cuts.

Opaque

“Trust us” with no audit trail.

Limited Access

1.7B unbanked globally.

DeFi (Powered by BlockchainTechs.io)

Permissionless

Your wallet = your bank.

Instant

Settlements in seconds, 24/7.

Low-Cost

90% cheaper via smart contracts.

Transparent

Every transaction on-chain.

Borderless

Internet + crypto = financial freedom.

DeFi Use Cases: The Future is Already Here

From staking to disrupting Wall Street.

Problem

Banks reject 70% of SME loan requests.

DeFi Fix

Collateralize crypto, borrow instantly (e.g., Aave, Compound clones we’ve built).

Problem

Centralized exchanges hacked for $3B in 2022.

DeFi Fix

Trade peer-to-peer with no custody risk (e.g., Uniswap-style platforms we’ve engineered).

Problem

Savings accounts offer 0.5% interest.

DeFi Fix

Earn 5–20% APY by staking stablecoins.

Your Code. Your Rules. Zero Strings Attached.

At BlockchainTechs.io, we build your vision—not ours. Take 100% ownership of the code, IP, and future. No lock-ins, no hidden clauses, just pure innovation.

The Roadmap for Building a DeFi Apps

Strategy

Analysis & Planning

UI UX Designing

App Development

Testing

Deployment & Support

Technology Stacks of our DeFi App Development Company

Discover seamless integration, Scalability, and innovative solutions with our robust and versatile technology stack.

Java

Swift

React Native

Kotlin

Unity

Android Studio

MERN

Flutter

Apple X Code

Stripe

Figma

Adobe XD

Ethereum

Binance

Hyperledger

Polygon

Solidity

Solana

Fantom

Chainlink

Cardano

Ripple

Stellar

Tron

XDC

Optimism

Moonbeam

Your Blue Print is Awaits for DeFi!

Skip the guesswork. Let our experts craft a DeFi Development strategy for your business—free. No jargon, just results.

Why Choose Us for DeFi App Development Services?

We’re not coders. We’re financial anarchists with a license to build.

Zero Legacy Code

We build only on cutting-edge chains like Solana, Polkadot, and Ethereum L2s to ensure future-proof performance and scalability.Battle-Tested Security

With over 100 smart contracts audited and zero exploits since 2015, we provide unmatched reliability and trustworthiness.Regulatory Whisperers

We help you navigate SEC, MiCA, and FATF compliance seamlessly, ensuring your platform meets global regulatory standards.Full-Stack DeFi

From UI/UX to consensus algorithms, we deliver end-to-end DeFi development and infrastructure with total ownership of the stack.Client Stories, Lasting Partnerships

Got questions? We have answers!

Not necessarily. Modern DeFi apps are designed with intuitive interfaces and guided onboarding, allowing users to interact with tokens, staking, and lending without deep crypto expertise.

Security is maintained through smart contract audits, multi-signature wallets, encrypted data storage, and secure API integrations, ensuring assets and transactions are protected.

Yes. Cross-chain DeFi apps enable interoperability between multiple blockchain networks, enhancing liquidity, scalability, and wider access for users.

DeFi apps are developed as responsive web apps and native mobile apps, offering a seamless user experience across iOS, Android, and desktop devices.

Monetization includes transaction fees, staking commissions, in-app lending interest, tokenomics, NFT integration, and premium features for users.

Common types include exchange apps (DEX), lending and borrowing apps, staking platforms, yield farming apps, crowdfunding (ICO/IEO) apps, wallet apps, and asset management apps.

Compliance is integrated through KYC/AML modules, smart contract governance, and adherence to regional regulations like GDPR or local crypto laws.

Yes. Legacy financial apps can be upgraded with blockchain functionality, smart contracts, NFT integration, and wallet support to become decentralized platforms.

Through incentives like staking rewards, gamification, yield farming, token rewards, NFT perks, and community engagement within the app ecosystem.

Development time varies by app complexity, platform, integrations, and security requirements. A typical DeFi app can take 3–6 months for an MVP and 6–12 months for full-featured apps.

Get Estimate

Let’s create something extraordinary. Connect with Blockchain Technologies today!

Our Locations