Building a Crypto Trading Bot: A Step-by-Step Guide for Automated Trading

May 19,2025

Building a Crypto Trading Bot: A Step-by-Step Guide for Automated Trading

Want to know how a crypto trading bot works? You’re not alone. According to some market reports, the crypto trading-bot industry already has a valuation in the tens of billions of dollars and is expected to grow substantially over the next decade — one estimate places the market at around $40 billion today, with long-term forecasts running into the hundreds of billions by the early 2030s. These numbers show how automated trading has become crucial in today’s ever-changing cryptocurrency market, which itself is valued at over a trillion dollars.

Crypto trading bots make perfect sense in this environment. These automated programs run on preset algorithms and trade without human input while monitoring markets around the clock. AI-powered crypto bots are reshaping the scene by processing huge amounts of data and making systematic decisions rapidly. Building your own trading bot can boost efficiency and profits, whether you’re new to trading or a seasoned pro. This article walks you through the steps to create a bot that delivers real results.

What is a Crypto Trading Bot and Why It Matters

A crypto trading bot serves as your digital assistant in the complex world of cryptocurrency markets. These sophisticated computer programs use artificial intelligence and advanced algorithms to analyze market data, spot trading opportunities, and execute trades automatically for you. The crypto markets never sleep, unlike traditional stock markets with fixed hours. This makes bots valuable tools for traders looking to gain an advantage.

Key stats on bot adoption and market size

Crypto trading bots have shifted from niche tools to core infrastructure in digital-asset markets. Recent market research shows:

The global crypto trading bot market is projected at around USD 47.4 billion in 2025, with forecasts pointing to over USD 200 billion by 2035, assuming a CAGR of about 14% from 2026 to 2035.

Within this, the AI-powered crypto trading bot segment is estimated at USD 1.5 billion in 2024, with growth expectations reaching around USD 7.8 billion by 2033, at a CAGR of roughly 22% from 2026 onwar.

What’s driving this growth?

- 24/7 market coverage — Bots never sleep, making them ideal for around-the-clock crypto markets.

- Institutional participation — Trading firms and funds are increasingly using automated solutions.

- AI integration — Machine learning adds adaptability and speed to trading strategies.

- High-frequency demand — Speed and precision are now critical in volatile crypto trading.

Adoption snapshot:

KuCoin’s user community reportedly created millions of trading bots by late 2023, showing how prevalent automation has become. North America leads adoption, with Asia-Pacific fast gaining ground.

Top Bot Strategies of 2025 Talk to Our Experts Today!

Curious about which bot strategies perform best in 2025?

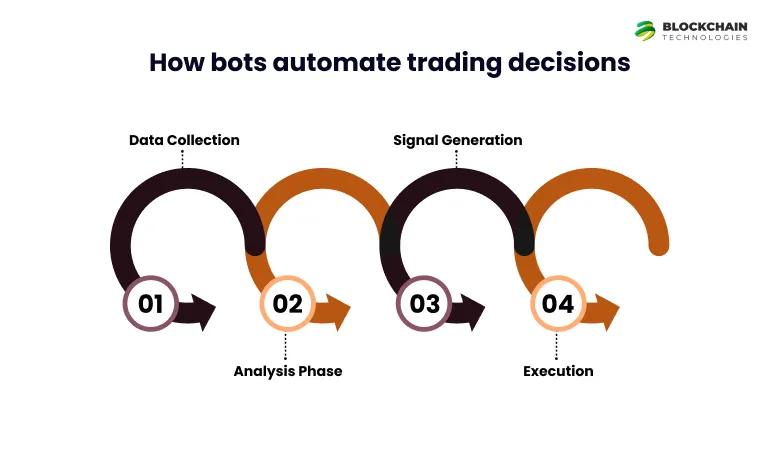

How bots automate trading decisions

Crypto trading bots work through a systematic process that copies expert trading decisions at superhuman speed. Integrating trading bots with cryptocurrency exchanges through API (Application Programming Interface). This creates a secure bridge between your trading account and the automated system. The automation cycle happens in four steps:

- Data Collection – The bot gathers massive amounts of immediate and historical market data, including price movements, trading volumes, order book information, and relevant indicators.

- Analysis Phase – The bot processes this information with programmed algorithms to identify patterns and potential trading opportunities based on predefined rules and strategies.

- Signal Generation – The analysis helps create trading signals that show when to buy or sell specific cryptocurrencies according to technical indicators like moving averages or RSI.

- Execution – The bot executes trades automatically when market conditions match your predetermined parameters and places orders within milliseconds.

These bots excel because they work without emotional bias. Human traders often make impulsive decisions based on fear or greed. Trading bots execute strategies with mathematical precision. They can also handle multiple trading pairs at once, which allows diversified strategies in different markets.

Ready to build your first trading bot?

Contact us to discuss your goals and get a prototype tailored to your strategy.

Choosing the Right Strategy Before You Build

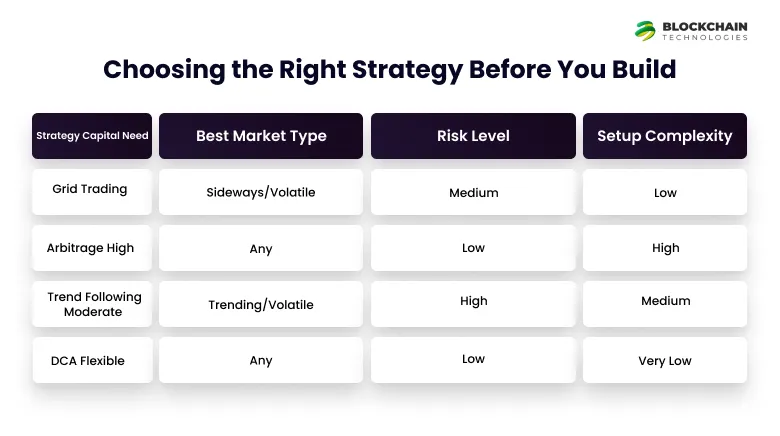

Picking the right trading strategy is your biggest decision before you go for cryptocurrency trading bot development. Each strategy works differently, and your choice shapes how well your bot handles market swings.

Get a Free Cost Estimate in Just 2 Minutes!

Whether you’re a startup or a seasoned exchange, our experts will tailor a bot solution that fits your needs and budget.

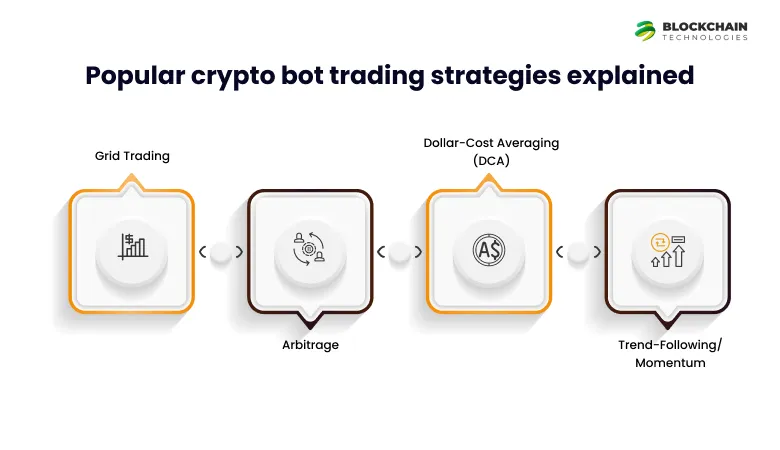

Popular crypto bot trading strategies explained

Trading bots can use several strategies that work best in specific market conditions:

Grid Trading: This strategy sets up buy and sell orders at fixed price points above and below the market price to create a “grid” of orders. It shines in sideways, volatile markets where prices bounce within expected ranges. Your bot buys at lower prices and sells at higher ones within your settings, which can lead to steady profits from price swings.

Arbitrage: This strategy makes money from price gaps between exchanges or markets. Latest numbers show traders put 86% of their money into crypto arbitrage bots. You’ll find these types:

- Spatial/Cross-Exchange Arbitrage: Buying on one exchange and selling on another

- Triangular Arbitrage: Trading between three different currencies on the same exchange

- Statistical Arbitrage: Using data analysis to predict price movements based on patterns

Dollar-Cost Averaging (DCA): These HODL bots invest fixed amounts at regular times whatever the price. The strategy spreads your entry price over time and helps handle market swings. DCA bots have done well in choppy markets – backtests show 58.12% returns for ETH and 80.92% for SOL during volatile periods.

Trend-Following/Momentum: These bots spot and ride market trends by buying in uptrends and selling in downtrends. They work great in strong trending markets but can struggle when prices move sideways.

How to match a strategy to your goals

Your strategy choice depends on several things:

- Trading Style Matters: The way you want to trade shapes your bot’s strategy – whether it’s scalping, day trading, swing trading, or holding long-term positions.

- Market Conditions Count: Each strategy works better in certain market conditions. Grid bots usually do better in sideways markets, while trend-following bots excel in volatile directional markets.

- Know Your Risk Level: Some strategies like arbitrage have lower risk but smaller returns. Others like momentum trading might bring bigger profits but carry more risk.

- Time Available: Think about how much time you can spend watching and tweaking your bot. Some strategies need more attention than others.

- Money to Start: You need more capital for some strategies, especially ones that spread orders across multiple exchanges.

Unlock the Right Bot Strategy Fast – Get Our Free Framework & Call

Get our Strategy Selection Framework and find your perfect bot strategy in under 10 minutes!

- Always backtest with a minimum of 12-month historical data

- Begin with paper trading before using real capital

- Set clear stop-loss and take-profit rules

- Limit API permissions to the minimum necessary

- Monitor performance dashboards daily

- Review bot logs weekly and adjust parameters quarterly

Real-life use case of a cryptocurrency trading bot

Here’s a practical example of how a funding-rate arbitrage bot can work using a market-neutral strategy. The bot runs two main approaches: positive carry and reverse carry. Below is a simplified positive-carry scenario.

1. Market conditions

Spot market: BTC/USD = $30,000

Perpetual futures market: BTCUSD-PERP = $30,050

Funding rate: 0.0013% per hour (paid by long futures to shorts)

2. Bot actions

To capture the positive funding rate while staying market-neutral, the bot:

- Buys 1 BTC on the spot market at $30,000

- Shorts 1 BTCUSD-PERP contract at $30,050

This creates a hedged position:

- Long 1 BTC (spot)

- Short 1 BTC (perpetual futures)

3. Results after one day (24 hours)

a) Funding income

Hourly funding:

0.0013% × $30,050 ≈ $0.39

Over 24 hours:

$0.39 × 24 ≈ $9.38

So, funding income ≈ $9.38 for the day.

b) Price convergence profit

Assume that by the next day, spot and futures converge at $30,025:

- Spot leg: Bought at $30,000, sold at $30,025 → +$25

- Futures leg (short): Short from $30,050, closed at $30,025 → +$25

So, price convergence profit = $25 + $25 = $50.

c) Total profit (ignoring fees and slippage)

Funding income: ≈ $9.38

Price convergence: $50

Total profit ≈ $59.38 over one day.

Build Your Own Arbitrage Bot – Get the Step-by-Step Blueprint!

Want to build your own arbitrage bot? Grab our step-by-step Arbitrage Bot Blueprint now!

Tools and Tech Stack You’ll Need

Your next vital step in creating a profitable crypto trading bot development is to put together the right tech stack after choosing your strategy. Here’s a walkthrough of the essential tools that will transform your trading strategy into a working automated system.

Best programming languages for building a crypto bot

The foundation of your trading bot starts with picking the right programming language. Python stands as the clear favorite, with 70% of crypto bot developers using it because of its simplicity and robust libraries. The Python ecosystem has powerful packages like:

- NumPy and Pandas for data analysis and manipulation

- Matplotlib and Seaborn for visualizing trading patterns

- SciKit-Learn and TensorFlow for implementing machine learning algorithms

JavaScript stands as the second most popular choice, particularly for developers who create web-based dashboards or Node.js applications. C++ gives speed advantages to high-frequency trading systems where microseconds count. Pick a language that matches your technical background and bot requirements. Python works best for beginners and data-heavy strategies, while C++ suits those who need ultra-fast execution speeds.

How to Build a Crypto Trading Bot Step-by-Step

Your strategy and tech stack are ready. Let’s take a closer look at the actual building process of your crypto trading bot. This step-by-step guide will show you how to turn your trading ideas into a working automated system.

1. Define your bot's architecture

Your crypto trading bot’s architecture works as its brain—the central system that processes information and makes decisions. Think of it as the blueprint that determines your bot’s behavior in different market conditions. A solid bot architecture has:

- Data processing module that handles market information and indicators

- Decision-making engine containing your trading algorithms

- Execution component that interfaces with exchange APIs

- Monitoring system for tracking performance and alerts

The architecture should map out all processes in your bot’s operation, from market data sources to trading algorithms and execution scripts. These are the building blocks that power your bot.

2. Write and test your trading logic

The architecture is ready, so coding comes next. Of course, you don’t need to start from scratch—many developers use GitHub’s open-source code as their foundation. Start by converting your trading strategy into algorithmic rules. To name just one example, a simple moving average crossover strategy needs code that:

- Calculates short and long-term moving averages

- Identifies crossover points

- Generates buy/sell signals based on these crossovers

- Implements position sizing and risk management rules

Testing becomes crucial before using real money. In fact, backtesting runs your bot against historical market data to find bugs and improve performance. More testing means better preparation for live markets.

Build Your Custom Crypto Trading Bot Today

Automate your trades with precision-built bots designed by experts.

3. Connect to exchange APIs securely

API keys bridge your trading bot and crypto exchanges. They enable automated actions like placing orders and checking balances. Proper security for these connections stands as the most important safety measure in your setup. Setting up API connections requires you to:

- Generate new API keys specifically for your bot (never reuse keys)

- Limit permissions to only what’s absolutely necessary

- Enable IP restrictions when available

- Never grant withdrawal rights unless specifically needed for your strategy

Different bot types need different API permissions. Arbitrage bots might need transfer capabilities across exchanges, while standard trading bots usually only require trading permissions.

Not Sure Which Strategy Fits Your Goals?

We’ll help you match the perfect trading strategy to your risk appetite and capital. Personalized Bot Strategy Framework

Testing, Backtesting, and Going Live

Testing your crypto trading bot is vital before you risk real money in the markets. Expert traders say good testing can separate profitable bots from those that empty your crypto wallet.

How to backtest your bot with historical data

Backtesting simulates how your trading strategy would have performed with past market data. This helps you learn about your strategy’s potential and spots weaknesses before going live.

Your bot needs proper backtesting:

- Gather accurate historical data – Results match your data quality. Find detailed price history with daily price and volume data from multiple years.

- Define clear parameters – Set specific rules for your strategy that include entry/exit points and risk management guidelines.

- Use specialized backtesting tools – TradingView, Backtrader, and platforms like Bitsgap and Gainium support various stats and analytics to help fine-tune your strategy.

Ultimate Backtesting Checklist: Validate Your Trading Strategy with Confidence

Get our Backtesting Checklist to ensure you’ve covered all vital aspects of strategy validation!

Using paper trading to simulate real conditions

Paper trading (or demo trading) lets you practice with fake funds in real-time markets without risk. Many platforms give you virtual funds automatically. Bitsgap offers demo accounts with simulated money to test strategies safely.

Paper trading setup is simple:

- Cryptohopper’s wizard adds virtual funds automatically.

- Gainium needs you to switch to Paper mode in your account menu and add a paper trading exchange with your chosen USDT amount.

- BitMEX users can access BitMEX Testnet built for beginners learning derivatives trading.

Paper trading mirrors real trading well but can’t match the emotions of risking actual money. Still, this step between backtesting and live trading helps find bugs, adjust settings, and build confidence. Start with an equity curve that shows your account balance changes. This chart reveals your bot’s direction right away. Add drawdown charts that show maximum losses to check risk management. Detailed analysis needs performance comparison views that show how strategies work in different markets. TradingView lets you add widgets for professional charts easily.

Key metrics to show:

- Profit/loss percentages in different timeframes

- Win rate and risk-to-reward ratios

- Sharpe and Sortino ratios for risk-adjusted returns

- Maximum drawdown periods

Take time to test your bot fully before using real money. Once backtesting and paper trading succeed, you can move to live trading with minimal risk.

Monitoring and Optimizing Your Bot Post-Launch

Starting a crypto trading bot marks the beginning of your trading experience. Your automated trading system needs constant monitoring and quick adjustments to succeed. Good oversight helps you spot inefficiencies, boost performance, and adapt your bot to market changes.

Setting up alerts and performance dashboards

Immediate monitoring serves as the life-blood of successful trading bot management. Your oversight needs these detailed monitoring elements:

- Multi-channel alerts – Set your bot to send notifications through backup channels (email, mobile, SMS) for critical events. This eliminates single points of failure in your communication system.

- Priority-based notifications – Distinguish between urgent situations that need quick action (connectivity issues, unusual trade patterns) and regular updates.

Build a dashboard that turns data into useful information. Your monitoring setup works best with these distinct zones: The best dashboards show key metrics like equity curves, win/loss ratios, profit factors, maximum drawdowns, and Sharpe ratios. Tools like Streamlit let you create dashboards quickly with minimal code.

Supercharge Your Bot Monitoring with Our Free Performance Dashboard Template

Take your bot monitoring to new heights with our free Performance Dashboard Template – it has pre-configured alerts and visualization widgets!

The right time and method to adjust your strategy

Think over your optimization with evidence-based decisions rather than quick reactions to temporary market changes. Pick a specific trading sample size to analyze—then pause your bot to assess its performance. Watch for these signals that show you need strategy adjustments:

- Technical changes in market structure (volatility changes, volume patterns)

- Lower profit factors or rising maximum drawdowns

- Losing trades that exceed historical patterns

Split your data into in-sample and out-of-sample segments when testing parameter changes to avoid curve fitting. Small adjustments work better than complete overhauls. This helps you see how specific changes affect performance.

Track Every Move: Free Bot Performance Tracker with Unlimited History

Monitor like a pro! Get our free Bot Performance Tracker with unlimited historical data storage.

Integrating Your Trading Bot with Cryptocurrency Exchanges

Connecting your bot with your cryptocurrency exchange platform is critical. Our bots use secure API connections to access your account, retrieve market data, and execute trades. We implement:

- REST and WebSocket APIs for real-time data

- Rate-limiting and error-handling logic

- IP whitelisting and token encryption for security

Proper integration ensures seamless, real-time trading across multiple markets.

Benefits of Build a Crypto Trading Bot with Us

In the fast-changing world of cryptocurrency, automation is a must-have, not just a nice-to-have. At Blockchaintechnologies we create top-notch crypto trading bots that help traders make decisions faster, boost their earnings, and rule the markets. Our bots are custom-made to match your specific trading aims, whether you’re looking after a portfolio or fine-tuning a payment gateway plan.

1. Quick Work and Split-Second Action

Our bots crunch huge amounts of up-to-the-minute market info in the blink of an eye making sure trades happen super fast when every second counts. While people might miss chances because they’re slow or not paying attention, our smart bots never take their eyes off the ball—they jump on trades the moment everything lines up right.

2. Cool-Headed, Plan-Based Choices

Kiss fear, greed, and snap decisions goodbye. Our bots stick to pre-set plans without getting emotional. This strict, rules-based approach leads to better results over time—when markets go crazy or tank.

3. Non-Stop Market Watching

Crypto markets don’t take breaks, and our bots don’t either. We create bots that can scan many exchanges all day and night spotting promising setups—even when you’re not looking. This means you’ll never miss a chance period.

4. Testing Past Data and Tweaking Plans

Before you go live, you can test your custom-built bot against years of old data to fine-tune when it enters and exits trades, and how much risk it takes. Our team digs deep during this process helping you make it work better in the real world and keep your money safe.

5. Juggling Different Markets

Our bots can handle many strategies, trading pairs, and exchanges, so you can spread out your investments . Whether you trade spot, futures, or look for price differences, our bots can manage complex tasks across a big trading portfolio without cutting corners

6. Mobile Monitoring Access

All our bots come with a responsive dashboard accessible on desktop and mobile. Track performance, adjust parameters, or pause bots on the go with our secure mobile interface.

Things to Consider Before You Make Your Crypto Trading Bot – And How We Help

Starting a money-making crypto trading bot begins with the right plan and the right team. At Blockchaintechnologies, we walk with you through the whole process—from brainstorming and design to launch and fine-tuning after it’s live.

Here’s how we help you succeed:

- Built by Experts We don’t just plug and play. Our team of developers builds bots from scratch. They know their stuff when it comes to algorithmic trading, cybersecurity, and working with blockchain.

- Tech Stack That Fits We’ll help you pick the right tech for what you need. This could mean Python, Node.js, Web3, or AI/ML – whatever works best for your project and how fast you need it to run.

- Keeping Things Safe We set up bots on cloud platforms we trust. We use strict API rules allow certain IPs, and keep data encrypted. This keeps your money and information safe.

- Clear Plan of Action Each project comes with a clear plan. You’ll know what’s happening when it’s happening, and how well it’s working. No surprises – just a clear path forward.

- Support & Fine-tuning That Keeps Going Our job doesn’t end when we hand over your bot. We keep an eye on it, take care of it, and make it better after launch to help you stay on top of market shifts.

Find the Right Bot for Your Trading Goals

Get personalized guidance to match you with a bot strategy that fits your unique trading style.

Conclusion

A winning crypto trading bot isn’t just about code—it’s about strategy, execution, and intelligent monitoring. At Blockchaintechnologies, we specialize in building custom crypto trading bots that go beyond automation. Our bots are engineered to trade 24/7, eliminate emotional errors, and respond to market movements in milliseconds—giving you the edge manual trading simply can’t provide.

As the market races toward a projected $50 billion by 2032, automated trading isn’t just an advantage—it’s a necessity. But success doesn’t come from generic tools or copy-paste code. It comes from purpose-built bots backed by deep market insight, rigorous testing, and continuous optimization—exactly what we deliver.

Whether you’re an individual trader, a hedge fund, or a crypto startup, we’ll tailor a solution to your strategy, risk appetite, and trading goals. From initial consultation to launch, and beyond—we’re with you at every step.

Let’s build your bot. Let’s build your edge.

FAQs

A successful crypto trading bot typically consists of a data processing module, decision-making engine, execution component, and monitoring system. These components work together to analyze market data, make trading decisions, execute trades, and track performance.

Backtesting is crucial when developing a crypto trading bot. It allows you to evaluate your strategy’s performance using historical data, helping identify weaknesses and optimize parameters before risking real capital. Thorough backtesting can significantly improve your bot’s chances of success in live markets.

Python is the most popular choice for crypto bot development, used by 70% of developers due to its simplicity and robust libraries. JavaScript is the second most common, while C++ is preferred for high-frequency trading systems requiring ultra-fast execution speeds.

To ensure security, generate new API keys specifically for your bot, limit permissions to only what’s necessary, enable IP restrictions when available, and never grant withdrawal rights unless absolutely required. Additionally, implement multi-channel alerts and use secure coding practices to protect your bot and assets.

Continuous monitoring is essential for maintaining a successful trading bot. Set up real-time alerts and performance dashboards to track key metrics. Evaluate your bot’s performance regularly, but avoid making frequent changes based on short-term fluctuations. Instead, establish a specific trading sample size for analysis before considering strategy adjustments.