How to Use AI for Crypto Trading: Build an Advanced Crypto Trading Platform from Scratch

May 29,2025

The fusion of Artificial Intelligence (AI) and cryptocurrency trading is reshaping the digital finance landscape, bringing unmatched speed, accuracy, and data-driven precision to a market known for its volatility.

Did you know? The global AI crypto trading market is projected to exceed $2.3 billion by 2027, driven by the rapid adoption of intelligent automation tools and increasing demand for 24/7 trading efficiency (MarketsandMarkets).

With nonstop market activity, unpredictable price swings, and a surge of retail investors, traders, especially small businesses and tech-savvy individuals, are increasingly turning to AI-based crypto trading platform development to stay ahead of the curve.

In this guide, you’ll learn:

- What AI crypto trading is and how it outperforms traditional trading methods

- How to build an AI-powered crypto trading platform from scratch, including essential technical components

- The best AI crypto trading bots and tools to watch in 2025

- Core benefits, key challenges, and what the future of AI in cryptocurrency trading holds

What is AI-Powered Crypto Trading and How It Works

Welcome to the brain of automated digital asset trading. AI-powered crypto trading is the use of artificial intelligence and machine learning crypto trading algorithms to analyze real-time market data, predict future trends, and execute automated trades with precision and speed. Unlike traditional manual trading, it eliminates emotional bias and relies solely on data-driven strategies to optimize outcomes.

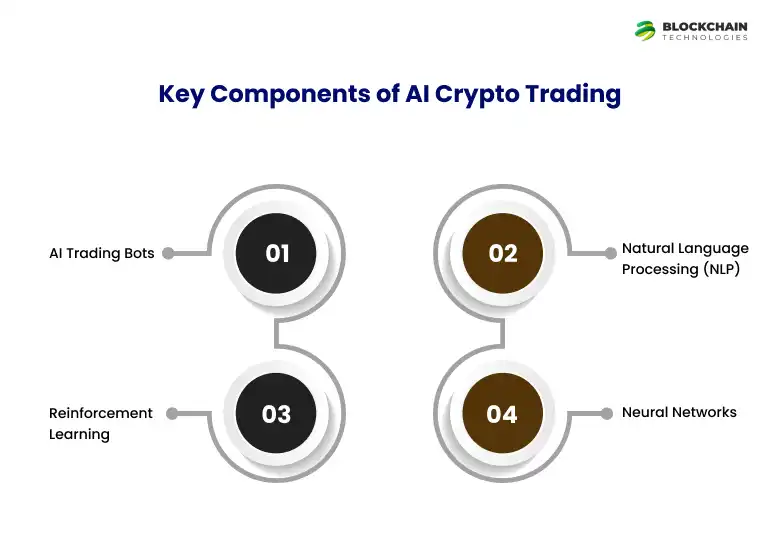

Key Components of AI Crypto Trading

Let’s break down the core pillars of an AI crypto trading system:

AI Trading Bots

Top AI crypto trading bots for beginners are trained to automatically buy and sell crypto assets based on pre-set rules, market signals, or live data feeds. Ideal for high-frequency and 24/7 trading.

Natural Language Processing (NLP)

This AI subfield interprets data from news headlines, social media, blogs, and financial reports, helping bots make trades based on real-time sentiment analysis.

Reinforcement Learning

A dynamic learning system where the AI gets better with every trade. It evaluates trade outcomes, adjusts strategies, and optimizes future decisions. This is essential for building self-learning crypto trading algorithms.

Neural Networks

Mimicking the human brain, neural networks identify non-linear relationships in massive datasets to forecast future price movements. These deep learning models are the backbone of accurate price prediction engines.

Traditional vs AI Trading: What Sets It Apart?

When it comes to crypto trading, the difference between manual trading and AI-driven crypto trading is like comparing a calculator to a supercomputer. Traditional traders rely on gut feeling, manual chart analysis, and time-consuming execution. In contrast, AI-powered trading leverages automation, real-time data, and smart algorithms to act instantly and accurately.

Here’s a side-by-side look at how AI vs traditional trading truly stacks up:

| Feature | Manual Crypto Trading | AI-Powered Crypto Trading |

|---|---|---|

| Decision-Making | Emotion-driven, based on intuition or charts | Data-driven, backed by AI algorithms |

| Speed of Execution | Manual entry, delay in placing trades | Millisecond-level auto execution with AI trading bots |

| Market Monitoring | Limited to trading hours or attention span | 24/7 real-time monitoring and execution |

| Strategy Development | Based on human experience | Constantly optimized with machine learning models |

| Backtesting & Simulation | Limited or done manually | Automated and extensive historical data testing |

| Adaptability | Slow to adapt to market changes | Learns and evolves via reinforcement learning |

| Scalability | Hard to scale with multiple assets | Easily handles multi-asset portfolios and exchanges |

| Emotional Influence | High – fear and greed impact trades | Zero emotional bias, pure logic and numbers |

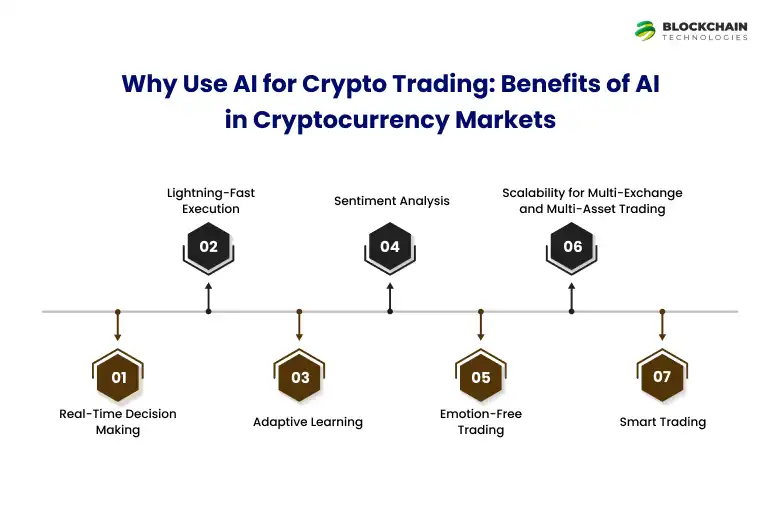

Why Use AI for Crypto Trading: Benefits of AI in Cryptocurrency Markets

In today’s volatile crypto environment, reacting a few seconds too late can mean a missed opportunity, or worse, a big loss. That’s where AI-powered crypto trading shines. It brings speed, precision, and adaptability that human traders simply can’t match. By using AI in cryptocurrency trading development, investors can process large-scale market data, eliminate emotional biases, and execute trades in real time.

Let’s break down the benefits of AI in crypto trading and how it changes the game for modern traders.

1. Real-Time Decision Making

AI systems analyze millions of data points in real time, including price trends, volume patterns, and even social sentiment.

- Uses machine learning crypto trading algorithms to make instant decisions

- Supports predictive modeling for price forecasting

- Detects micro-trends and market anomalies others miss

3. Adaptive Learning

These systems improve over time, learning from each trade to enhance accuracy and performance.

- Uses reinforcement learning to fine-tune strategies based on past outcomes

- Learns what works best under specific market conditions

- Automates portfolio rebalancing based on learned patterns

4. Sentiment Analysis

Not all data is numerical, news and tweets move markets too. AI uses Natural Language Processing (NLP) to capture this sentiment.

- Analyzes real-time news, blogs, and social media chatter

- Detects fear, hype, or optimism in the market

- Uses sentiment score to trigger or delay trades

5. Emotion-Free Trading:

Unlike humans, AI doesn’t panic-sell or overtrade during market highs.

- Makes decisions based on data, not emotion

- Follows predefined logic under all market conditions

- Minimizes the risk of impulsive behavior

6. Scalability for Multi-Exchange and Multi-Asset Trading

AI solutions are not limited by bandwidth or sleep. They can trade across multiple exchanges and asset types at the same time.

- Tracks dozens of cryptocurrencies simultaneously

- Monitors multiple APIs and market feeds

- Scales effortlessly for individuals or trading firms

7. Smart Trading

Traders are increasingly adopting AI-driven crypto trading strategies for 2025 like sentiment-based scalping, reinforcement learning for adaptive models.

- Uses ML algorithms to make instant, data-driven trades.

- Predicts price movements with precision through advanced modeling.

- Spots hidden micro-trends and anomalies others overlook.

Challenges in AI-Powered Cryptocurrency Trading

The synergy between Artificial Intelligence (AI) and cryptocurrency trading is redefining how investors approach the market. While AI introduces unmatched speed, accuracy, and automation, it also comes with its own set of challenges. Understanding both sides of the coin helps traders and firms leverage the tech more responsibly and effectively.

Here’s a look at the challenges of AI in crypto trading, and how they impact real-world decision-making.

Challenges of AI in Crypto Trading

Despite its promise, AI-powered cryptocurrency trading development comes with certain technical and operational limitations that need to be addressed for long-term success.

1. Data Quality and Noise in Crypto Markets

Garbage in, garbage out, AI is only as good as the data it learns from.

- Crypto markets are highly volatile and prone to manipulation

- Poor data inputs lead to inaccurate predictions

- Requires constant filtering and data validation

2. Model Overfitting and Black-Box Decisions

AI models may perform well in training but fail in live markets.

- Advanced cryptocurrency trading with machine learning can overfit to past data

- Some AI models act as “black boxes” with limited explainability

- Regulatory frameworks require transparency and auditability

3. High Infrastructure and Computational Costs

AI trading isn’t plug-and-play, it demands serious resources.

- Requires high-performance computing environments

- Cloud infrastructure and API integrations are essential

- Smaller firms may find it cost-prohibitive without scale

4. Security Risks and Algorithmic Vulnerabilities

With automation comes the risk of exploitation or failure.

- Trading bots may malfunction or be hacked

- Bugs in the code could trigger unintended losses

- Strong cybersecurity practices are non-negotiable

Dominate the Crypto Curve!

Master the markets with intelligent AI trading bots and stay ahead with predictive modeling and instant decisions.

How to Leverage AI for Crypto Trading: Build an Advanced Crypto Trading Platform from Scratch

Creating a custom AI crypto trading platform means combining intelligent data analysis, real-time decision-making, and secure infrastructure. To stay ahead in volatile markets, your platform must be scalable, adaptive, and fully automated. Let’s explore how to Build an AI-Based Crypto Trading Platform.

1. Define Your Strategy and Architecture

A solid foundation starts with identifying your trading model, execution layers, and infrastructure. Define your use of machine learning crypto trading algorithms, and decide on your deployment (cloud, hybrid, or edge). Align your tech stack like Python, Node.js, REST APIs, etc., with the platform’s expected throughput.

Before writing a single line of code, clarity is key.

- Choose between day trading, scalping, swing trading, or arbitrage

- Define whether your system will use rule-based bots or machine learning crypto trading algorithms

- Map out cloud infrastructure, APIs, storage, and latency requirements

2. Integrate AI Trading Bots

AI trading bots development execute pre-programmed strategies with real-time market analysis and instant trade execution. They rely on signal triggers like Bollinger Bands, RSI, and MACD to place trades. These bots integrate with exchange APIs like Binance, Coinbase Pro, or KuCoin for direct transactions.

Your core trading logic needs to be AI-driven for real-time performance.

- Develop AI trading bots that scan markets 24/7

- Use market indicators, moving averages, and real-time data feeds

- Automate buy/sell orders based on strategy thresholds and triggers

Smarter, Decentralized Data Processing

When we talk about AI’s role in blockchain data processing, it’s all about distributing intelligence across nodes,freeing AI from central control and enhancing fairness.

- AI algorithms can be deployed in decentralized AI systems, where they function across multiple nodes.

- This prevents single points of failure and promotes data sovereignty.

3. Price Forecasting

Neural networks use layers of data abstraction to detect patterns in market movements. Feedforward and LSTM networks are ideal for time-series predictions in crypto. By training these models on OHLC data and order books, they forecast future price trends with adaptive accuracy.

- For smarter trading, integrate learning-based predictive models.

- Train neural networks on historical crypto data (OHLC, volume, sentiment)

- Predict short-term and long-term price patterns

- Utilize RNNs (Recurrent Neural Networks) or LSTM (Long Short-Term Memory) for time-series data

4. Integrate Sentiment Analysis

Natural Language Processing (NLP) algorithms interpret unstructured data from news, tweets, and forums. With tools like BERT and Vader, NLP assesses sentiment polarity (positive/negative/neutral). These insights act as external signals to enhance trading models during high-impact events.

Your system should read the news, literally.

- Leverage Natural Language Processing (NLP) to analyze news headlines, Reddit, and X (Twitter) chatter

- Calculate sentiment scores to influence trading decisions

- Identify potential volatility triggers in real time

5. Strategy Optimization

Reinforcement learning improves trading performance through trial and error, simulating how bots learn from each trade. The system uses reward functions based on profits and penalizes losses. Over time, it dynamically adjusts strategies to optimize long-term returns.

Make your system smarter with every trade it makes.

- Apply reinforcement learning to help your bot learn from trade outcomes

- Reward successful actions, penalize poor ones

- Continuously update strategy parameters based on performance

6. Build a Real-Time Dashboard and Monitoring System

A real-time dashboard ensures visibility into every component of your AI crypto trading platform. Use frameworks like React for the frontend, WebSockets for live data, and Grafana for monitoring. The dashboard can show active bots, trade history, live charts, and AI-generated predictions.

Transparency and control are everything in AI crypto trading.

- Create a user dashboard for real-time PnL, order status, and market analytics

- Include visualization of bot activity and AI decisions

- Integrate alerts and manual override functions

7. Ensure Security, Compliance & Fail-Safes

Security is mission-critical when dealing with real funds and sensitive data. Use AES encryption, token-based API authentication, and secure socket layers (SSL). Also, integrate anti-latency scripts, bot abuse detection, and ensure AI in crypto trading follows KYC/AML regulations.

Protecting funds and meeting legal standards is non-negotiable.

- Use encryption, two-factor authentication (2FA), and secure API keys

- Monitor for bot manipulation or DDoS attacks

- Ensure your AI engine complies with local financial regulations

8. Backtesting and Paper Trading Before Going Live

Before deploying, test every bot under different conditions using backtesting engines. Simulate trades with real-time market feeds using platforms like Backtrader or QuantConnect. Analyze strategy performance metrics such as Sharpe ratio, maximum drawdown, and win rate.

Test your AI before it touches real money.

- Backtest strategies using historical data for different market conditions

- Run paper trading simulations in real-time environments

- Fine-tune parameters based on win/loss ratio, drawdowns, and latency

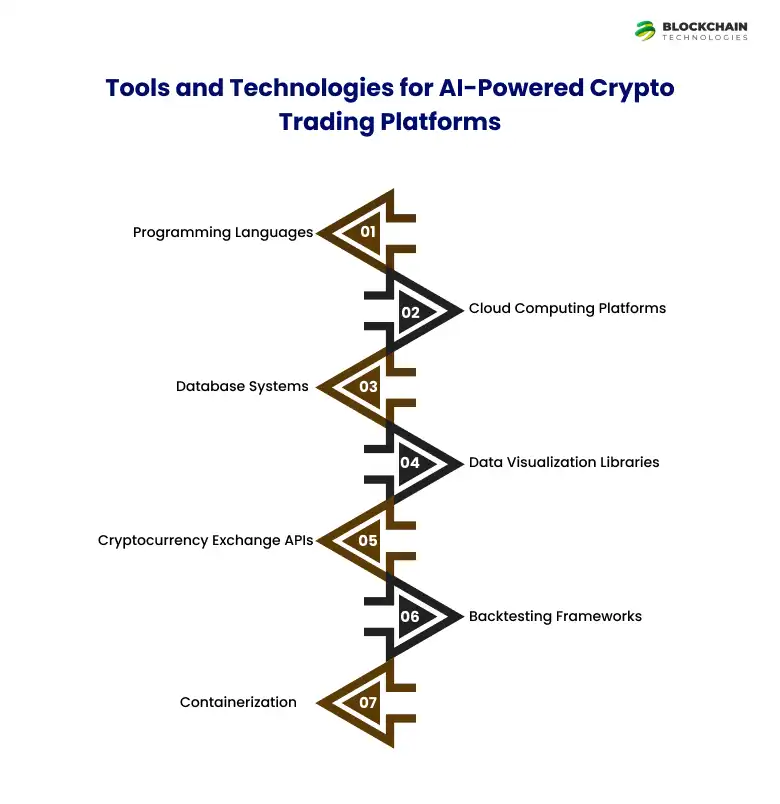

Tools and Technologies for AI-Powered Crypto Trading Platforms

Building and managing an AI crypto trading platform is about integrating the right AI tools for real-time crypto trading strategies, frameworks, and scalable technologies. From modeling with Python to deploying in the cloud, every layer matters in making automated trading smart, responsive, and profitable.

Programming Languages

To build an AI crypto trading bot, Python is the gold standard, thanks to its vast ecosystem. Libraries like TensorFlow, PyTorch, Scikit-learn, Pandas, and NumPy are used for model training, data manipulation, and AI integration.

Cloud Computing Platforms

AI-based crypto trading platforms demand scalable infrastructure, and that’s where AWS, Google Cloud, and Azure come in. These platforms offer GPU instances, auto-scaling, and ML tools like SageMaker for robust training and deployment pipelines.

Database Systems

Efficient handling of real-time market data and bot actions requires high-performance databases. Tools like PostgreSQL and TimeScaleDB are ideal for storing large-scale, time-series trading datasets with precision and speed.

Data Visualization Libraries

Understanding how your bot performs is key. Libraries like Matplotlib, Seaborn, and Plotly let you create interactive visual dashboards that showcase price movement, model confidence, PnL, and trade frequency.

Cryptocurrency Exchange APIs

APIs are your bridge to live markets. Libraries like CCXT standardize connections with major exchanges (Binance, Coinbase, Kraken), allowing real-time data pulls and auto-execution of trades.

Backtesting Frameworks

Before going live, backtest your AI trading strategy using tools like Backtrader and Zipline. These simulate trades on historical data, helping optimize performance and minimize real-money risks.

Containerization

To ensure seamless deployment across environments, containerization tools like Docker and Kubernetes are essential. They allow version control, load balancing, and horizontal scaling for global trade execution.

Ready to build your own AI crypto trading platform?

Talk to our experts and explore the best AI tools for real-time, automated crypto trading.

Use Cases: How Different Businesses Can Leverage AI in Crypto Trading

Individual Traders

Individual traders can now access smart bots, AI-driven insights, and portfolio optimization tools once exclusive to financial institutions. Automate trades, reduce emotional decision-making, and trade 24/7, even while you sleep

Institutional Traders

Institutions can leverage AI for high-frequency trading, large-scale portfolio management, and real-time risk analysis. By integrating AI-powered crypto trading platforms, institutional traders benefit from data-driven decisions, better compliance, and higher profitability at scale.

Banks & Financial Institutions

Banks are tapping into AI crypto trading to expand digital asset services, offer robo-advisory, and stay ahead in the digital finance race. From algorithmic trading to predictive modeling, AI enables smarter crypto strategies aligned with regulatory frameworks.

AI Crypto Trading Platform Development Cost: Complete Breakdown

Curious about how much it costs to build an AI-powered crypto trading platform? From infrastructure to AI model integration, the AI crypto trading platform development cost depends on features, scale, and customization levels. Let’s break it down to help you plan effectively.

| Component | Details | Estimated Cost |

|---|---|---|

| Core Development & Engineering | UI/UX design, trading engine, API integration | $15,000 – $50,000 |

| AI & Machine Learning Integration | Predictive modeling, neural networks, training, NLP-based sentiment models | $10,000 – $40,000 |

| Data Sources & API Integration | Live market feeds, historical data, exchange APIs (e.g., Binance, Coinbase) | $3,000 – $10,000 |

| Cloud Infrastructure & Hosting | Scalable deployment on AWS, Azure, or Google Cloud | $5,000 – $15,000 per year |

| Backtesting & Simulation Tools | Historical trade simulation, strategy tuning (Backtrader, Zipline) | $2,000 – $7,000 |

| Security & Compliance | KYC/AML, encryption, 2FA, penetration testing, regulatory standards | $5,000 – $20,000 |

| Ongoing Maintenance & Support | Model retraining, system updates, bug fixes | $1,000 – $5,000 per month |

Total Estimated Cost Range: $40,000 – $150,000+

The cost of developing an AI crypto trading platform for small businesses depends heavily on the feature set, data complexity, and AI sophistication. MVPs can help reduce initial costs while laying the groundwork for future scaling.

The Future of AI in Crypto Trading

As the crypto landscape evolves, the future of AI in crypto trading lies in real-time decision-making, personalized automation, and intelligent risk mitigation, making AI the ultimate co-pilot for digital asset investors.

- Hyper-Personalized Trading Strategies AI models will learn from individual trading patterns to fine-tune custom AI crypto trading strategies dynamically.

- Wider Integration with DeFi and Web3 AI crypto bots will tap into DeFi protocols and smart contracts to execute trades autonomously across decentralized platforms.

- Deeper Real-Time Sentiment Analysis Natural Language Processing will extract emotions, market sentiment, and trader intent from on-chain data and Web3 chatter.

- Security and Fraud Detection Machine learning models will spot unusual trading behavior and protect against wash trading, spoofing, and flash loan attacks.

- Next-Gen AI Reinforcement learning will power AI agents that auto-optimize across multiple exchanges and trading pairs in real-time.

Conclusion: Partnering with the Right AI Development Company for Crypto Trading Success

The future of digital assets is undeniably being shaped by AI-powered crypto trading solutions. From predictive analytics to autonomous execution, AI unlocks the ability to trade faster, smarter, and more profitably, without the emotional pitfalls of human decision-making.

So, if you’re a crypto startup, exchange, or fintech innovator, building your own AI crypto trading bot from scratch requires more than just algorithms, it needs deep expertise in machine learning, real-time data engineering, and secure API integration.

Looking to build your next-gen AI crypto bot?

Let’s connect and transform your trading vision into reality with Blockchaintechs.io, your partner in intelligent automation.

FAQs:

Discover bots like 3Commas, Pionex, and Cryptohopper that offer user-friendly AI tools, low entry barriers, and automated strategies.

Development costs can range from $25,000 to $150,000+ depending on complexity, tech stack, and integrations.

Yes, AI trading bots are legal in most countries, but make sure to comply with regional financial regulations.

Absolutely. AI platforms help small businesses trade efficiently, reduce risks, and optimize profits using automation and real-time insights. For budget-friendly solutions, Blockchaintechs.io, stands out as a affordable AI crypto bot development company, offering smart, scalable, and custom-built trading bots tailored to small business needs.

By using machine learning crypto trading tools that analyze market sentiment, price history, and indicators to predict trends.