The AI-NFT Fusion: Redefining Creativity in the Digital Art World

May 20,2025

Top AI-Powered Crypto Trading Bots for Smarter Investments

Precision and speed are critical in a market as volatile and fast-moving as cryptocurrency. The constant fluctuations and the sheer volume of data can make it challenging to identify profitable trading opportunities. This is where AI crypto trading bots come into play, offering the potential for automated crypto trading and smarter investment decisions. According to a report by MarketsandMarkets, the global AI in fintech market is expected to reach $42.83 billion by 2025, with a major chunk attributed to AI in cryptocurrency and crypto trading automation. By leveraging the power of AI in cryptocurrency, these sophisticated tools analyze market trends, identify patterns, and execute trades automatically, 24/7. For both experienced traders and newcomers, leveraging AI trading software can enhance strategy execution, reduce emotional decision-making, and unlock smart investment strategies.

In this guide, we’ll explore:

- What are AI crypto bots for smart investment strategies, and how they work.

- Pros, cons, and limitations of AI trading bots.

- How to choose the right AI trading bot for your goals.

- The best AI-powered crypto trading bots for 2025.

What are AI-Powered Crypto Trading Bots?

AI-powered crypto trading bots are intelligent software programs built with machine learning algorithms, predictive analytics, and big data to autonomously execute crypto trades. Operating 24/7, they analyze real-time market signals, historical data, and technical indicators to adjust strategies on the fly. They serve as the core of automated crypto trading, ideal for high-frequency trading, arbitrage, scalping, and trend-following.

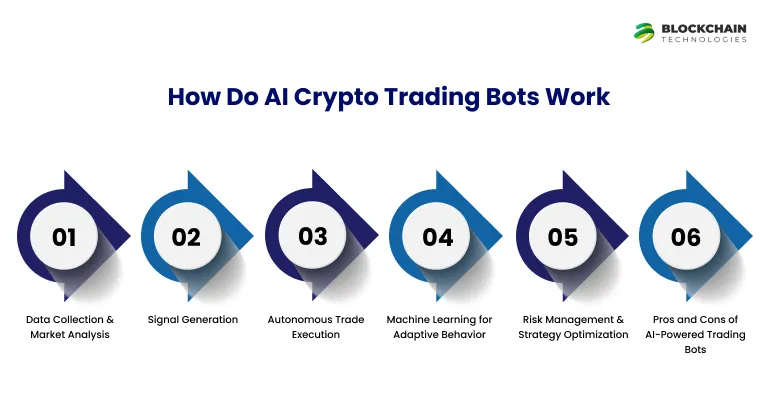

How Do AI Crypto Trading Bots Work?

Ever wondered how AI enhances crypto trading strategies? Let’s break down the key processes behind the top AI crypto bots for beginners strategies:

1. Data Collection & Market Analysis

AI trading bots start by scraping massive amounts of real-time and historical market data. They analyze everything from price charts and order books to social sentiment and macroeconomic trends. This step fuels real-time AI crypto trading bots with market analysis capabilities.

2. Signal Generation

The bots apply predictive algorithms and deep learning to process technical indicators like RSI, MACD, moving averages, and Bollinger Bands. These form the foundation of decision-making.

3. Autonomous Trade Execution

Once the signals are identified, the bot quickly places buy/sell orders on connected exchanges. This is the magic of crypto trading automation, human emotion is eliminated, and trades are executed with precision.

4. Machine Learning for Adaptive Behavior

Top-tier bots use reinforcement learning models to analyze the outcomes of previous trades and tweak strategies accordingly. This continuous learning keeps them responsive in ever-shifting markets.

5. Risk Management & Strategy Optimization

Integrated risk controls like stop-loss, trailing-stop, and position sizing allow the bot to manage your portfolio safely while maximizing gains.

Pros and Cons of AI-Powered Trading Bots

Thinking of using AI crypto trading bots for automated crypto trading, and for AI for Trading Apps. Here’s a quick look at the key benefits and drawbacks to help you make smarter investment decisions with AI-powered crypto trading software.

| Pros | Cons |

|---|---|

| 24/7 Automated Trading | Setup may require technical expertise |

| Eliminates Emotional Bias | Vulnerable to flash crashes and anomalies |

| Backtests Historical Strategies | Performance varies by provider |

| Scalable and Fast Execution | Limited foresight on black swan events |

| Handles High-Frequency Trading | Can incur high subscription costs |

| Executes Based on Real-Time Data | Requires regular monitoring and adjustments |

| Enhances Strategy Consistency | Limited adaptability in highly volatile markets |

Tired of Emotional Trading?

Let AI be your rational guide in the wild world of cryptocurrency markets!

How to Choose the Right Crypto AI-Powered Trading Bot?

Choosing the perfect trading assistant is about aligning its capabilities with your investment strategy and risk tolerance. Here’s what to focus on when considering how to choose the right AI trading bot for crypto:

1. Strategy Customization

Flexibility is key. Whether you’re into day trading, swing trading, or HODLing, ensure the bot supports strategy customization to match your style.

2. Exchange Integration

Check if the bot integrates with your preferred crypto exchanges like Binance, Kraken, or Coinbase. Multi-exchange compatibility is a plus for portfolio diversification.

3. Security Infrastructure

Your funds and data must be protected. Look for bots that use API key encryption, two-factor authentication (2FA), and secure server environments.

4. Community & Support

Reliable bots come with great documentation, responsive customer support, and a strong user community. These resources help troubleshoot issues and optimize performance.

5. Backtesting and Analytics Tools

Ensure the bot offers advanced backtesting capabilities using historical data, as well as real-time analytics to fine-tune strategies over time.

6. Pricing and Transparency

Understand the pricing model, subscription, commission-based, or one-time fee, and make sure there are no hidden charges.

“AI will eventually take over 90% of trading, it’s faster, smarter, and emotionless. The real winners will be those who adapt early.”

Changpeng Zhao (CZ), Founder of Binance

Top AI-Powered Crypto Trading Bots for Beginners and Enterprises:

So, if you’re just starting out in crypto trading or you’re a seasoned pro, AI-powered crypto trading bots development is a game-changer. These bots leverage advanced machine learning, big data, and predictive analytics to help you make smarter investment decisions, automate trades, and enhance overall trading strategies. Below, we’ll dive into some of the top AI-powered crypto trading bots best for beginners and most affordable alike.

1. 3Commas

3Commas is an excellent choice for traders of all levels. It offers a user-friendly interface while also providing advanced features for seasoned professionals.

- Beginners will appreciate the intuitive smart trading terminal, which simplifies crypto trading and provides real-time AI crypto trading bot with market analysis, making it easier to understand trading trends.

- Pro traders can use the platform’s custom bots and strategy automation tools to develop sophisticated trading strategies with advanced AI-powered algorithms.

- The platform supports multiple exchanges, including Binance and Kraken, making it highly versatile.

- Its backtesting capabilities allow users to test strategies using historical data, ensuring that your bots execute trades based on data-driven insights.

Strategies:

- Dollar-Cost Averaging (DCA)

- Grid Trading

- Smart Covering

Pricing:

- Free Plan (limited features)

- Starter: $29/month

- Advanced: $49/month

- Pro: $99/month

2. Cryptohopper

Cryptohopper is a cloud-based AI crypto trading bot designed to simplify trading for beginners while offering advanced features for experienced traders.

- For beginners, Cryptohopper offers easy-to-use pre-built templates, allowing you to start trading with minimal setup.

- Experienced traders can enjoy the flexibility to create their own custom trading strategies using technical indicators like RSI, MACD, and more.

- The bot also comes with backtesting and paper trading features, giving you the opportunity to test strategies before going live.

- AI-driven market analysis ensures that trades are based on current market trends and historical data, increasing the accuracy of trade executions.

Strategies:

- AI Sentiment Analysis

- Technical Analysis with Backtesting

- Arbitrage & Mirror Trading

Pricing:

- Pioneer: Free

- Explorer: $19/month

- Adventurer: $49/month

- Hero: $99/month

3. Bitsgap

Bitsgap is another top choice for both beginners and pros. It offers a comprehensive crypto trading platform with powerful AI trading bots designed to automate and optimize trades across various exchanges.

- For beginners, Bitsgap’s intuitive interface allows users to set up bots quickly, even without prior experience. Its simple layout helps newcomers track trades and portfolios with ease.

- For advanced traders, Bitsgap offers intelligent grid bots and arbitrage trading tools that leverage AI to find price discrepancies across different exchanges.

- Bitsgap supports more than 25 exchanges, offering a wide range of options for crypto investors looking for diversification.

- The platform’s real-time analytics provides ongoing updates on trading performance, helping you adjust strategies for better results.

Strategies:

- AI Grid Trading

- Cross-Exchange Arbitrage

- Trailing Stop Bot

Pricing:

- Basic: $29/month

- Advanced: $69/month

- Pro: $149/month

4. TradeSanta

TradeSanta stands out for its easy setup process and customizable trading strategies, making it ideal for beginners looking to automate their trades without much complexity.

- Beginners can start using pre-configured strategies like long and short bots, ensuring they make profitable trades without needing to delve deep into technical analysis.

- Pro traders can customize the settings, fine-tuning the bots for more precise trading strategies. With tools like AI-driven indicators and emotional trade avoidance, TradeSanta minimizes the risk of costly errors.

- The bot supports several major exchanges, including Binance and Huobi, making it flexible for different traders.

- Automated trading frees up time, while backtesting features help traders analyze past performance and refine strategies.

Strategies:

- Long/Short AI Preset Strategies

- MACD and RSI-Based Trading

- Volume Filter Integration

Pricing:

- Free Plan (2 bots only)

- Basic: $25/month

- Advanced: $45/month

- Maximum: $70/month

5. Shrimpy

Shrimpy focuses on AI-powered portfolio management, making it an excellent choice for long-term crypto investors. It offers robust automation features tailored to users who want to optimize portfolio allocation.

- For beginners, Shrimpy simplifies portfolio management by automatically balancing assets and rebalancing the portfolio according to predefined goals.

- Pro traders can benefit from Shrimpy’s advanced portfolio analytics, which tracks real-time market movements and suggests the best action based on current market conditions.

- The platform supports a wide array of exchanges and offers API integration, allowing users to automate portfolio management across multiple platforms.

- Shrimpy’s social trading features allow traders to follow and copy strategies from top performers, providing insights into successful strategies.

Strategies:

- Portfolio Rebalancing

- Index-Based Investment

- Social Copy Trading

Pricing:

- Starter: Free

- Professional: $15/month

- Enterprise: Custom Pricing

Comparison of Best AI-Powered Crypto Trading Bots 2025

| Bot Name | Best For | AI Strategies Used | Pricing (Monthly) | Key Highlights |

|---|---|---|---|---|

| 3Commas | Visual Strategy Building | DCA, Grid Trading, Smart Covering | Free - $99 | Intuitive UI, drag-and-drop bot builder, integrated with major exchanges |

| Cryptohopper | Cloud AI Strategy Designer | Sentiment Analysis, Backtesting, Arbitrage, Mirror Trading | Free - $99 | Cloud-based bot, marketplace for pre-set strategies, real-time AI signals |

| Bitsgap | Arbitrage & Grid Bot Users | Grid Trading, Arbitrage Finder, Trailing Bots | $29 - $149 | Powerful AI-based arbitrage engine, multiple exchange connections |

| TradeSanta | Quick AI Bot Setup | AI Presets (MACD/RSI), Long/Short, Volume Filters | Free - $70 | Beginner-friendly interface, pre-configured strategies, high automation |

| Shrimpy | Long-Term Investment & Rebalancing | Portfolio AI Rebalancing, Social Trading, Index Investing | Free - $15+ (Custom for Enterprise) | Focused on portfolio management with AI-powered indexing and rebalancing |

Unlock Consistent Crypto Profits!

Discover how AI can help you navigate market volatility and achieve your financial goals!

Cost of Development: What Does It Take to Build an AI-Powered Crypto Trading Bot?

Building an AI-powered crypto trading bot is about combining intelligent algorithms, secure integrations, and real-time trading logic. The cost of development can vary based on complexity, feature set, and security requirements.

| Feature Set | Approximate Cost (USD) |

|---|---|

| Basic AI Trading Bot (single exchange, simple strategy) | $5,000 – $10,000 |

| Intermediate Bot (multi-exchange, ML-based predictions) | $10,000 – $25,000 |

| Advanced Bot with Deep Learning, Risk Management, Custom Dashboards | $25,000 – $50,000+ |

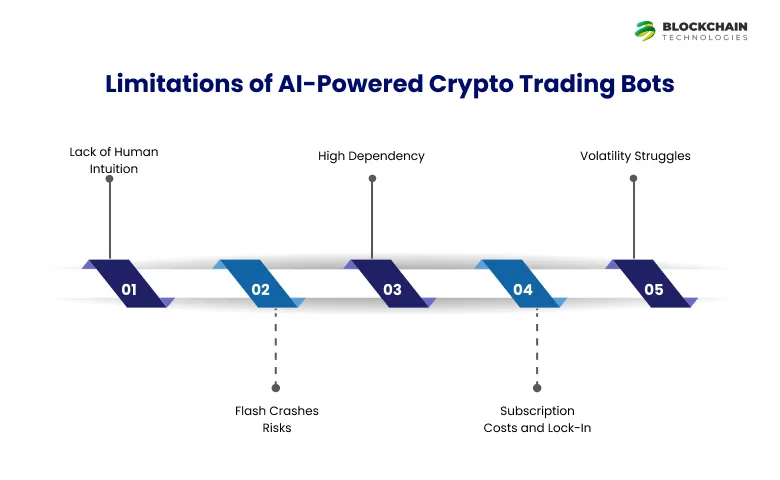

Limitations of AI-Powered Crypto Trading Bots

While AI crypto trading bots offer speed, precision, and automation, they’re not without flaws. Understanding the limitations of AI trading bots is essential before diving into full automation. Even the best crypto trading bots may struggle in unpredictable or extreme market conditions.

1. Lack of Human Intuition

AI bots rely on pre-set logic, historical data, and pattern recognition. They lack the emotional intelligence and contextual judgment that seasoned human traders can apply during black swan events or policy changes. This is a core reason why AI in crypto investment decisions still needs oversight.

2. Flash Crashes Risks:

Many smart trading bots execute trades within milliseconds, but in manipulated or illiquid markets, their speed becomes a double-edged sword. They may react to false signals or suffer losses during flash crashes without understanding the broader narrative.

3. High Dependency

Automated crypto trading systems rely heavily on real-time data. If there’s a lag, missing API update, or misinterpreted signal, bots can make irrational trades. This emphasizes the importance of using real-time AI crypto trading bots with market analysis for consistent results.

4. Subscription Costs and Lock-In

Most best automated crypto trading platforms with AI come with tiered pricing models. Advanced strategies or high-frequency trading often require premium plans. Additionally, switching platforms may involve reconfiguring bots from scratch, which isn’t always beginner-friendly.

5. Volatility Struggles

While crypto trading automation works well during normal trading volumes, bots often fail to anticipate major market reversals or political upheavals that affect asset value. They lack foresight and operate only within data-fed boundaries, making human monitoring crucial.

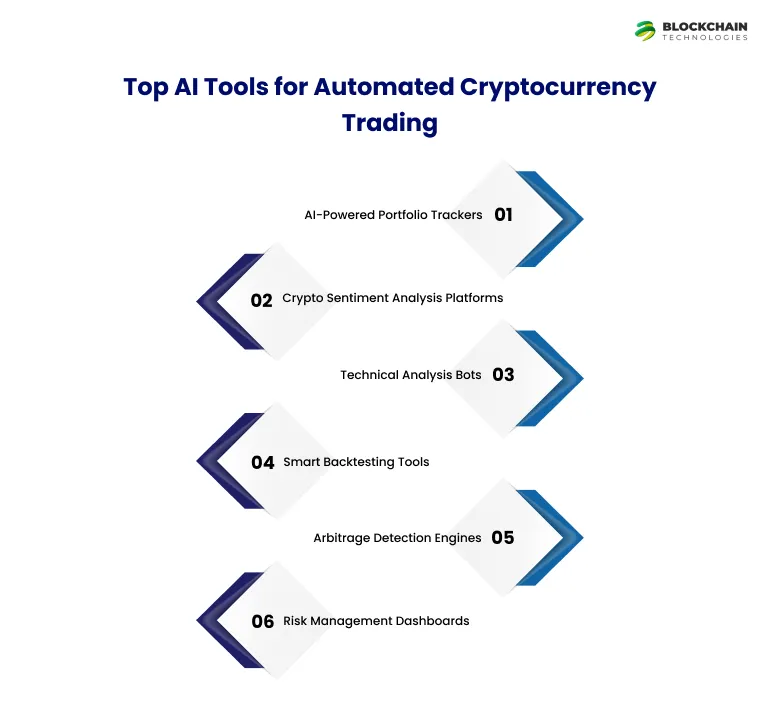

Top AI Tools for Automated Cryptocurrency Trading

To fully unlock the potential of AI crypto trading bots, traders need the right tools by their side. These tools enhance automation, ensure precision, and bring deeper market insights. Let’s explore the top automated cryptocurrency trading tools that help in maximizing returns and minimizing risks.

1. AI-Powered Portfolio Trackers

These tools allow traders to track multiple wallets and exchanges through a unified dashboard. AI portfolio management systems use predictive analytics and trend analysis to suggest rebalancing strategies based on historical data and market signals.

- Example Tools: CoinStats, Kubera, Shrimpy

- Key Feature: Unified tracking + rebalancing based on AI signals

2. Crypto Sentiment Analysis Platforms

AI sentiment analysis tools for crypto trading scan social media, forums, and news to detect bullish or bearish trends before the market reacts. These insights are vital for decision-making in short-term trades.

- Example Tools: LunarCrush, Santiment, IntoTheBlock

- Key Feature: Real-time market sentiment scores powered by NLP

3. Technical Analysis Bots

AI technical analysis bots use machine learning to identify patterns like RSI, MACD, Bollinger Bands, and more. These bots help automate technical strategy creation and execution.

- Example Tools: TradingView AI Plugins, Cryptohopper TA Bots

- Key Feature: Strategy suggestions based on AI signal convergence

4. Smart Backtesting Tools

Backtesting tools use historical data to simulate trading outcomes. With AI-powered crypto backtesting tools, you can validate a strategy under different market conditions and improve success rates.

- Example Tools: 3Commas Backtester, Coinrule, Trality

- Key Feature: AI scenario simulation for risk profiling

5. Arbitrage Detection Engines

AI arbitrage bots track hundreds of exchanges simultaneously and alert users to profitable price differences. These bots are essential for high-frequency traders and scalpers.

- Example Tools: Bitsgap Arbitrage Bot, HaasOnline

- Key Feature: Real-time cross-exchange pricing analysis

6. Risk Management Dashboards

These dashboards allow traders to set intelligent stop-loss, take-profit, and risk thresholds. Advanced crypto risk management tools with AI dynamically adjust limits based on volatility and portfolio exposure.

- Example Tools: Quadency Risk Engine, 3Commas SmartTrade

- Key Feature: Volatility-adjusted trade execution

How to Choose the Right AI Trading Bot Development Company

Choosing the right AI crypto trading bot development company is crucial for building a reliable and efficient trading bot. Here are key factors to consider when making your selection:

1. Partner with a Trusted AI Trading Bot Development Company

Ensure you partner with an experienced company like Blockchaintechs.io, known for delivering high-performance AI trading bots tailored to meet specific market needs. Their expertise in machine learning ensures that your bot will be optimized for real-time decision-making.

2. Evaluate Technical Expertise

The company must have strong skills in blockchain integration, API management, and data analysis to ensure smooth bot operations across platforms. Look for a company proficient in AI algorithms that can adapt to fast-moving markets.

3. Assess Security Measures

Security is vital in crypto trading; look for companies that implement data encryption and secure API integration to protect against cyber threats. Compliance with KYC/AML regulations ensures your bot operates securely.

4. Customization and Scalability

Ensure the company offers customizable solutions that can evolve with your trading needs. They should provide scalable systems capable of handling increased market activity and more complex strategies.

5. Proven Track Record and Portfolio

A strong track record in AI trading bot development indicates reliability. Look for companies that have delivered successful bots with measurable results, backed by client reviews and case studies.

6. Customer Support and Maintenance

Ongoing customer support and maintenance ensure your trading bot continues to operate smoothly, even with platform updates or market changes. Choose a company that provides continuous software upgrades and assistance.

Wrapping Up

In conclusion, AI crypto trading development offers a transformative advantage in automating trading strategies, enhancing speed, and reducing human error in volatile markets. By leveraging machine learning algorithms, AI in Blockchain Development, and real-time data analysis, businesses can optimize their investment strategies with precision and efficiency. As the demand for advanced AI-driven trading solutions continues to grow, choosing the right development company is crucial to ensure your bot is reliable, secure, and adaptable to market changes.

When looking for the top AI crypto trading bot development companies in the USA and Australia, Sunrise Technologies stands out as a leading provider. Known for their expertise in AI-powered trading systems, they offer cutting-edge solutions that meet the dynamic needs of cryptocurrency markets. With a focus on scalable and customizable AI trading bots, Sunrise Technologies ensures high-quality, secure, and efficient solutions to help businesses achieve smarter, data-driven investment decisions.

Ready for Smarter Crypto Investments?

Experience the difference AI can make in your trading performance and portfolio growth!

FAQs

The best AI crypto bot for small businesses is one that offers user-friendly dashboards, customizable strategies, real-time analytics, and multi-exchange support. Popular options in 2025 include 3Commas, Bitsgap, and custom-built AI bots tailored to specific business needs.

Platforms like Bitsgap, 3Commas, and Shrimpy top the list due to robust AI engines and multi-exchange support.

AI enhances strategies by reducing human bias, identifying real-time trends, and optimizing trade entries and exits using predictive models.

Costs typically range from $5,000 to $50,000+ based on features and complexity. For affordable, high-quality development, check out BlockchainTechs.io for tailored solutions.

AI crypto trading bots use machine learning algorithms to analyze market trends, price patterns, and historical data to make automated trading decisions. For beginners, these bots simplify crypto investing by handling trades 24/7, minimizing emotional decision-making, and optimizing entry and exit points with little to no manual intervention.